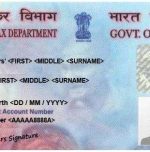

PAN Card Verification Process

Permanent Account Number (PAN) is a ten-digit alphanumeric ID issued by the Income Tax Department.

It is one of the most essential documents related to financial matters. PAN was the only document with which the taxpayers can file their income tax returns until the Finance Ministry issued a notification in the recent budget about Aadhaar card.

The Finance Ministry announced in the recent budget that those who do not have a PAN number can file their ITR using their Aadhaar number. Those people will be issued a PAN card automatically.

This reveals the importance of PAN in financial matters.

While issuing the PAN, a third-party verification would be done to cross-check the identity and address of the applicants. This is called PAN verification process.

The PAN verification also includes the authenticity of the documents submitted by the applicant.

PAN card verification is three types.

File-based PAN card verification is used to verify up to 1,000 PAN cards by larger organizations.

Screen-based PAN card verification is done for up to 5 PAN cards at a time. All the 5 cards would appear on the screen in the boxes. When clicking on submit, the response would appear.

Software (API)-based PAN card verification involves the use of software application. A person can verify his or her PAN online by visiting the verification portal.

PAN cardholders can verify their PAN card online by visiting the Income tax e-filing portal. Users need to log in to their e-filing account.

Navigating to profile settings and selecting ‘My Profile’ option, users can view the details including name, date of birth and PAN number.

Then, they have to provide the status like individual, HUF, company etc. After that, they have to enter the captcha and click on submit option to get their PAN verified.

For bulk verification, users need to register them as an agency and choose Bulk PAN query and click on ‘Upload Query’. Then, they have to click on the submit option after which a token number will be generated. Then the status of the PAN would be shown.

Leave a Reply