Get PAN Card to make better Financial Transactions

Do you have a PAN card? If not get one immediately for better financial transactions. This is because PAN card is mandatory for all financial transactions especially for huge transactions. Banks need PAN cards to open an account as per the norms of RBI.

PAN card is mandatory to deposit more than Rs. 50,000 rupees in banks, buy a bike or gold. It is also mandatory for foreign currency exchange, making FDs of more than Rs. 50,000 in banks and post offices, making cash payments of over Rs. 25,000 at hotels, share trading, investing in mutual funds, and taking loans and credit cards.

Any individual who earns a taxable income should apply for PAN card. And the businesses that have more than Rs. 5 lakhs of gross receipts or turnover per annum need PAN card.

The business intelligence project which was designed was by Income Tax department in last year February enables it to track the details of citizens who make transactions in huge amounts including buying a car or depositing huge amount in banks, etc.

The information will be sent to central information branch which sends messages or writes letters to them for seeking explanation about this income.

Individuals who make transactions like purchasing a plot or house worth more than Rs. 5,00,000 should furnish their PAN details. If the PAN number is not given, or such transactions are made without PAN, it is an offence. In such circumstances, IT department penalizes an amount of Rs. 10,000 to Rs. 20,000. Or the department has the power to send these transaction makers to jail. PAN can be applied at Income Tax Department. Applicants can find more details on incometaxindia.gov.in.

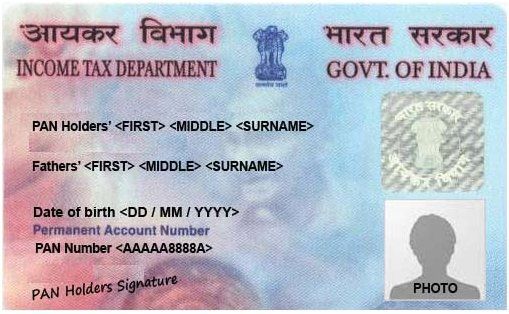

Image Credit: PageImp / CC BY-SA 4.0

Image Reference: https://commons.wikimedia.org/wiki/File:A_sample_of_Permanent_Account_Number_(PAN)_Card.jpg

Leave a Reply