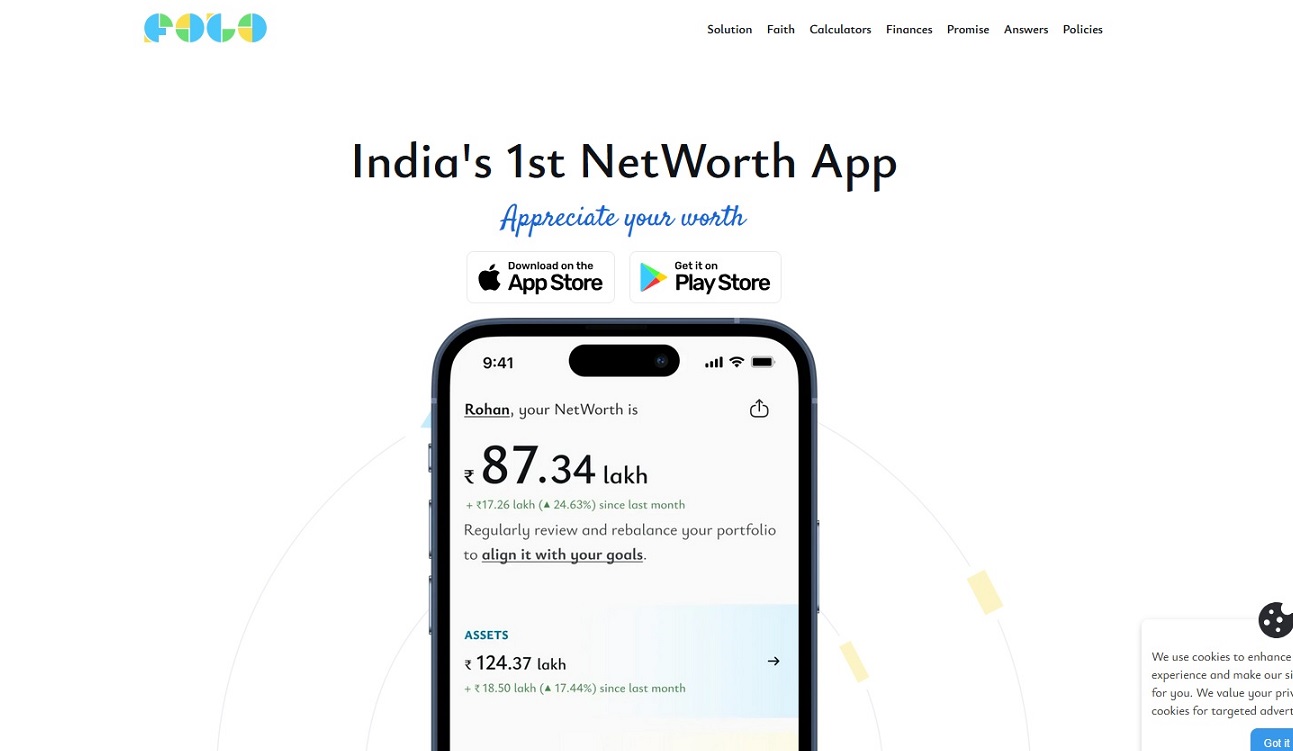

FOLO app aims to simplify family networth management

Managing personal wealth has become increasingly complex in today’s digital world.

Financial information is spread across banks, investments, insurance, and physical assets.

As a result, families often lack a clear, consolidated view of their net worth.

Addressing this challenge, Family of Loved Ones (FOLO) is set to launch India’s first connected net-worth management app on November 5.

FOLO was founded by Vishal Purohit and Munmun Desai and is based in Bengaluru.

The fintech startup focuses on solving fragmentation in personal finance. Most users rely on multiple apps, statements, or spreadsheets.

However, this approach limits visibility and long-term financial clarity. FOLO aims to replace this confusion with a single, integrated platform.

The app automatically syncs financial data across a wide range of sources. These include banks, stocks, mutual funds, loans, credit card dues, insurance policies, and retirement funds.

Additionally, FOLO tracks physical assets such as real estate and precious metals.

By aggregating data in real time, the app removes the need for manual updates. Consequently, users can view an accurate snapshot of their total net worth at any time.

According to co-founder Munmun Desai, modern wealth exists in many forms. Investments, property, digital assets, and insurance are spread across numerous platforms.

Data from FOLO shows individuals manage between 25 and 75 financial touchpoints. Therefore, visibility becomes a major challenge. FOLO focuses on clarity rather than adding another financial tool.

Behind its simple interface, FOLO uses encrypted and consent-based technology. It integrates with more than 350 regulated financial institutions.

This ensures both security and reliability. Moreover, the app introduces features designed for family access and planning. One such tool, Lync, allows users to securely share complete financial information with trusted family members.

FOLO also offers an Account Health Score feature. This tool scans for missing nominees, incomplete records, or mismatched personal details.

Such gaps often lead to unclaimed assets later. By identifying these risks early, FOLO helps users safeguard their wealth and reduce future complications.

Co-founder Vishal Purohit explains that FOLO is not built for transactions or credit. Instead, it focuses on organisation and understanding.

The app acts as an operating system for personal net worth. When users clearly see their finances, they make better decisions.

FOLO will debut on Product Hunt on November 5. A private launch event will follow in Bengaluru on November 7.

The app has already crossed 60,000 pre-launch downloads. Now, it is opening access to a wider audience.

Image Source: Folo Website Screenshot

Image Reference: https://www.folo.one/

Leave a Reply