Juno aims to redefine banking for crypto natives

As crypto adoption accelerates, a new wave of founders is challenging the limits of traditional banking. Juno is a crypto-first fintech startup co-founded by Varun Deshpande.

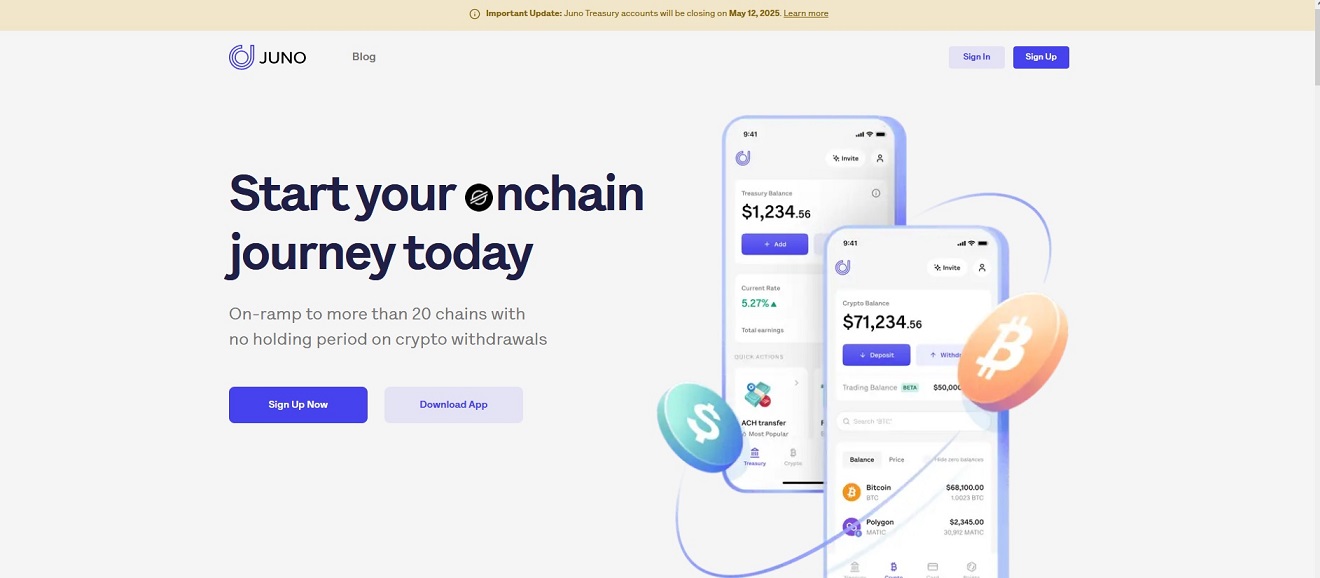

The company was launched with a clear goal: to build a modern checking account designed specifically for crypto-native users.

Deshpande and his founding team identified a growing gap in the U.S. financial system, where existing banks failed to support everyday crypto usage such as salary payments, spending, and on-chain investments.

Under the leadership of Varun Deshpande, Juno has grown rapidly within a short span of one and a half years.

The startup now serves more than 75,000 customers across the United States. Many of these users receive their salaries partially or fully in cryptocurrencies.

Deshpande has emphasised that long-term crypto believers need infrastructure that works seamlessly with both traditional finance and decentralised networks, without forcing users to constantly move funds between platforms.

The founders built Juno as a full-stack financial platform. It allows users to spend crypto and fiat using a Mastercard-powered debit card, pay bills, and transfer funds to traditional banks.

In addition, the leadership team prioritised access to Layer 2 blockchains such as Polygon, Arbitrum, and Optimism, enabling zero-fee onramps directly from checking accounts. This approach reflects the founders’ belief in scalable and low-cost blockchain adoption.

Juno’s founding team also focused heavily on compliance and usability. Automated tax reporting through Form 1099 was introduced to reduce friction for users. According to Deshpande, simplifying taxes is essential for mainstream crypto adoption.

The vision of the founders has attracted strong investor confidence. Juno recently raised $18 million in a Series A funding round led by ParaFi Capital’s Growth Fund.

The startup is also backed by Sequoia India’s Surge, Polychain Capital, Dragonfly Capital, and several prominent crypto leaders. Today, Juno processes over $1 billion in annualised transaction volume.

Despite regulatory uncertainty and market volatility, the founders remain focused on rebuilding banking around crypto and web3 principles.

Their long-term vision positions Juno as a potential blueprint for future financial systems, not only in the U.S. but also in emerging fintech markets like India, where digital finance continues to expand rapidly at a monetary scale.

Image Credit: Juno Website Screenshot

Image Reference: https://juno.finance/