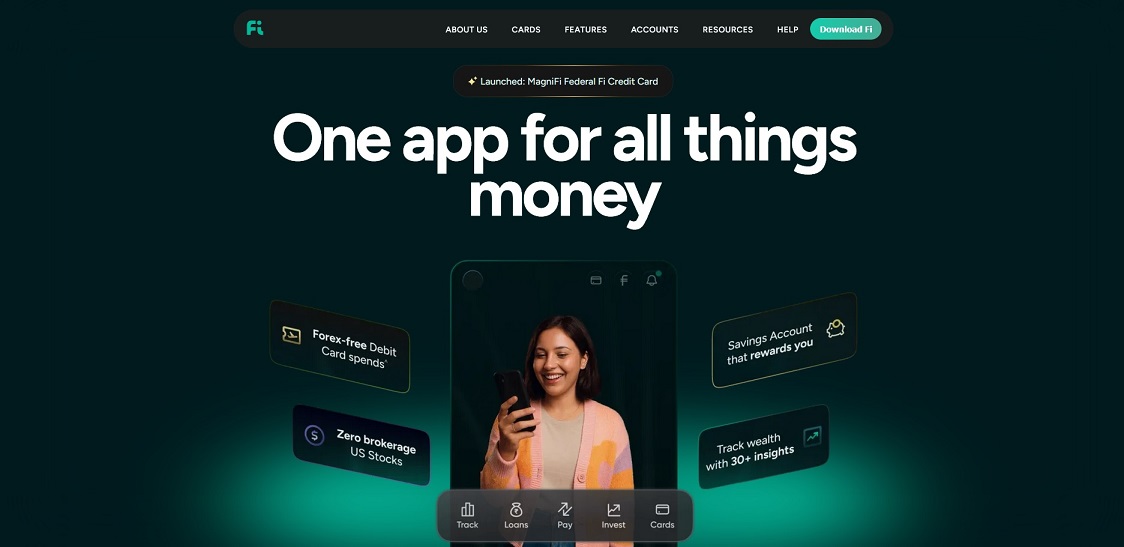

Fi: From EpiFi to a leading neobanking challenger

Originally launched as EpiFi, the neobanking startup now known as Fi is rapidly emerging as a strong contender in India’s digital-first banking landscape.

Founded in 2019 by former Google Pay executives Sujith Narayanan and Sumit Gwalani, the startup set out to redesign how urban professionals interact with their money.

Fi’s journey began at a difficult time. The Covid-19 pandemic delayed product rollouts across the neobanking sector, yet Fi managed to go live early.

Another major challenge arose from its partnership with Federal Bank. Since customers could open only one Federal Bank savings account, they had to choose between Fi and rival Jupiter.

Interestingly, this limitation temporarily worked in Fi’s favour. Its aggressive marketing and TV campaigns helped attract more early users.

Once Federal Bank resolved the one-account issue, both platforms became accessible, but the initial hitch gave Fi a crucial head start.

The startup had been working through a challenging fundraising phase, as securing fresh capital in a competitive ecosystem was not easy.

Despite this, it managed to enter advanced discussions for a new round of investment that was expected to strengthen its financial position.

The talks indicated renewed interest from prominent investors, along with continued confidence from its earlier supporters, reflecting the startup’s growing potential despite initial hurdles.

Fi previously raised $13 million in seed funding in January 2020, at a time when neobanks were securing capital even before launching products.

Today, Fi has around 2 lakh users, slightly ahead of Jupiter, though reports suggest its cash burn is also higher.

Although Fi does not hold a banking licence, its partnership with Federal Bank allows it to offer fully regulated savings accounts.

Its customer-centric features include:

- Zero-balance savings account

- Smart expense tracking

- Automated categorisation of spending

- Goal-based savings ‘jars’

These tools help users manage money effortlessly and gain better financial control.

Looking ahead, Fi aims to generate revenue through loans, investment products and card transactions, ultimately aspiring to become users’ primary bank account.

With strong momentum and clear customer appeal, Fi is positioning itself as a next-generation alternative to traditional, branch-heavy banking.

Image Credit: Fi Website Screenshot

Image Reference:

https://fi.money/