Income tax deductions permitted under Section 80C and 80D

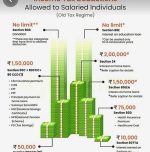

Income Tax Act allows tax deductions under various sections. Section 80 of the IT Act deals with various types of deductions. From section 80C to section 80U, there are various deductions for taxpayers to get exemptions in their taxable income.

These are covered in Chapter VI A of the Income Tax Act. While some deductions are available to individuals and HUFs, some others can be availed by all assessees.

Read the article to know about the various tax deductions allowed under Section 80 of the Income Tax Act.

80C: Many taxpayers are aware of this section. However, some of them do not know what actually falls in this category. Section 80C includes subsections 80CCC, 80CCD(1), 80CCD (1b) and 80CCD (2). The maximum deduction allowed under this section is ₹1.5 lakhs. Section 80C deals with the contributions made towards PPF, EPF, LIC premium, and principal repayment on the home loan.

Taxpayers are allowed an aggregate of ₹1.5 lakhs under 80C together with 80CCC and section 80CCD(1) even though they spend more than that. So, if you have made contributions towards all these sections and the home loan repayment and beyond the specified amount, still you can claim a maximum amount of ₹1.5 lakhs. You will not be able to claim beyond that limit even though you spend more.

Section 80CCC deals with the deduction concerning contribution to certain pension funds, while 80CCD(1) deals with the contribution to the pension scheme of the Central Government or NPS.

Taxpayers can also get a tax deduction of up to ₹50,000 on the investment made in NPS under 80CCD(1B). All eligible employees and self-employed taxpayers can avail this tax benefit. However, taxpayers cannot claim the same tax deduction under both sections.

Section 80CCD(2) deals with the contribution of the employer to the pension scheme of the Central Government. The deduction is allowed for up to 10% of the salary.

Section 80D deductions include payments made towards an insurance premium, preventive health checkups and medical expenditure for self and family members.

Taxpayers can claim up to ₹25,000 towards the premium paid. It is ₹50,000 for senior citizens. Taxpayers can claim deduction towards insurance premium paid for self, spouse, dependent children, and parents.

It includes preventive health check-ups and medical expenditure for parents up to ₹50,000. The maximum limit of 80D is ₹1 lakh.

Image by mohamed hassan from Pxhere (Free for commercial use / CC0 Public Domain)

Image Reference: https://pxhere.com/en/photo/1576171

Leave a Reply