Maximizing tax savings for seniors: A guide to Section 80TTB benefits

The financial landscape for senior citizens in India saw a significant improvement with the introduction of Section 80TTB by the Finance Budget 2018.

This provision is a boon for individuals aged 60 years and above, offering them a chance to reduce their taxable income through deductions on interest income from various deposits.

Mumbai-based tax and investment expert Balwant Jain offers insights into how senior citizens can leverage this section for better tax planning.

Under Section 80TTB, senior citizens are eligible to claim a deduction of up to ₹50,000 on interest earned from deposits in banks, post offices, and cooperative societies.

This encompasses savings, fixed, and recurring deposits, along with deposits under the Senior Citizen Saving Scheme, within the specified financial year.

It’s a comprehensive coverage that significantly benefits the elderly, ensuring a portion of their income remains untaxed.

Contrastingly, Section 80TTA provides deductions on interest income up to ₹10,000 but is exclusively available to individuals under 60 and HUFs, focusing solely on savings account interest.

Importantly, this benefit does not extend to senior citizens, who have a more advantageous threshold under Section 80TTB.

Key points of Section 80TTB include:

- Applicability to resident individuals aged 60 and above.

- Coverage for interest on bank, cooperative society, and post office deposits.

- Exemption of tax deduction at source (TDS) on interest income up to ₹50,000.

- A higher TDS exemption limit under Section 194A, complementing the deduction.

- Taxation of interest income exceeding ₹50,000 at applicable slab rates for seniors.

- Exclusion of company fixed deposits and bonds/NCDs from this deduction.

This strategic tax provision helps senior citizens safeguard more of their interest earnings from taxation, enhancing their financial well-being in retirement.

However, it’s crucial to note the exclusion of certain income types, like company fixed deposits, from this benefit.

Seniors looking to maximize their tax savings should carefully consider the types of deposits they hold, aiming to optimize their returns within the generous bounds of Section 80TTB.

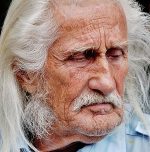

Image by Mohamed Hassan from Pxhere (Free for commercial use / CC0 Public Domain)

Image Reference: https://pxhere.com/en/photo/1584873

Leave a Reply