Decoding tax regimes for FY 2023-24: Choose wisely

With the onset of the new financial year, taxpayers face a crucial decision: selecting between the new and old income tax regimes for AY 2024-25.

This choice is pivotal, as each regime offers distinct tax rates and benefits.

The Income Tax Department has facilitated the e-filing for ITR-1, ITR-2, and ITR-4, emphasizing the need for an informed decision.

In the latest budget, Finance Minister Nirmala Sitharaman made significant changes to the new tax regime, enhancing its appeal. The income tax exemption limit saw an increase of ₹50,000, now set at ₹3 lakh.

Additionally, the rebate under Section 87A was raised, allowing individuals earning up to ₹7 lakh to enjoy a zero-tax threshold.

Here’s a brief comparison of the tax slabs under both regimes:

- For incomes up to ₹2.5 lakh, there’s no tax in either regime.

- The new regime provides a more lenient tax rate for incomes between ₹2.5 lakh to ₹6 lakh, compared to the old regime.

- Beyond ₹15 lakh, both regimes converge at a 30% tax rate.

It’s noteworthy that the new tax regime offers a simplified structure by removing many exemptions and deductions available under the old regime.

This makes it potentially more beneficial for those without significant savings or investments.

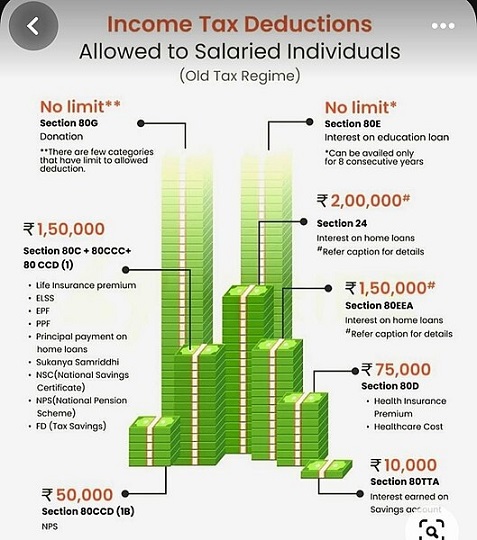

Conversely, the old regime may prove advantageous for individuals who can leverage various deductions and exemptions to reduce their taxable income.

The choice between the two regimes is not one-size-fits-all. It demands a thorough evaluation of one’s financial situation, including income, savings, and investment plans.

Consulting with a tax professional can provide personalized insights, making this decision less daunting.

Taxpayers with an income of up to ₹7 lakh might find the new regime more favourable due to the nil tax provision.

However, understanding the nuances of each regime is crucial in making an informed decision that aligns with one’s financial goals and tax-saving strategies.

Image Credit: KSTCNOW2024, CC0, via Wikimedia Commons

Image Reference: https://commons.wikimedia.org/wiki/File:Top_10_ITR_Filing_Documents.jpg

Leave a Reply