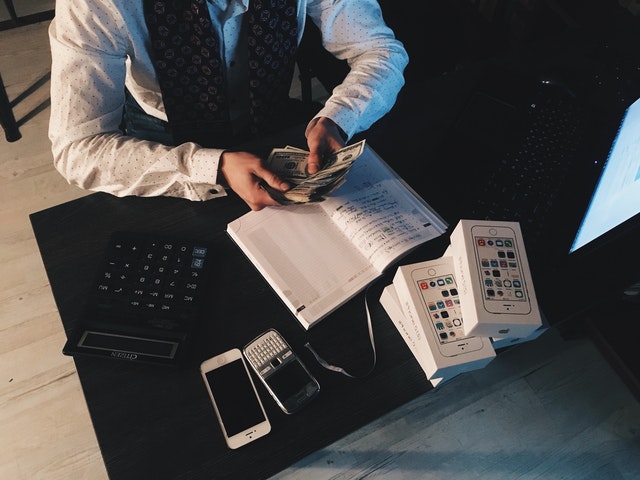

Financial tasks to do while moving abroad – 2

In the previous article, you have learned about some of the financial tasks that should be finished while moving abroad.

Here are the remaining financial tasks:

If you have a land or a house in India, then you can decide to liquidate it. If you are migrating to another country, then you will have to keep some ready cash to meet basic needs there. Also, in countries like the US or Canada, the residents will have to comply with provisions under the Foreign Account Tax Compliance Act (FATCA).

As per this, the earnings from investments outside the country of residence are restricted. So, please check the rules before moving to the country. Also, it is difficult for you to look after your property in India unless you have someone to take care of it.

If you have mutual funds, then you have to update your NRI status in your KYC details. Also, you should link your portfolio with your NRO account. But, evaluate additional expenses associated with it while doing so. After that, decide whether to keep or exit from your investment. If you decide to exit, you should also asses the exit load.

NRIs are not allowed to invest in PPF or NSC. However, if you have an account already before moving abroad, then you can keep your PPF account and earn interest on the deposited amount till then. However, you cannot make fresh deposits into the account. You can close your account or keep it till the end to earn full deposit with interest.

If you have a life insurance policy, then you can keep it and pay premiums on time. Vehicle and health insurance policies will not be required in India. In other words, you will have to get a health insurance policy in the country you are moving to. If you sell your vehicle, then there is no question of vehicle insurance. But, if your family members use your vehicle, they will have to pay the insurance premium. However, it is better to change the vehicle to their name.

Hire a good chartered accountant (CA) to avoid double taxation. Banks or AMCs will normally deduct taxes and pay to the government on bank deposits and mutual funds. But, it is better to seek the services of a CA to have clarity on your tax requirement.

Image Reference: https://www.pexels.com/photo/person-counting-money-with-smartphones-in-front-on-desk-210990/

Leave a Reply