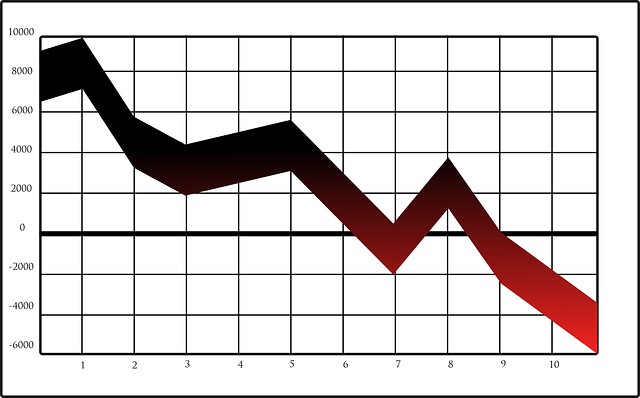

Domestic investors revive the hopes to Stocks

Due to the lack of proper returns on traditional bets, many investors in India are dividing into the country’s stocks. This is a sign of positivity from the government’s stewardship of the economy.

The enthusiasm which is being seen inside India seems to be contrasting the sentiment among global portfolio managers who are pulling their money out of stocks due to the nervousness regarding the possibility of higher interest rates in the U.S.

Investors additionally were spooked when Indian tax officers asked some global funds to retroactively pay a tax that they haven’t had to pay.

One year after his party swept to power in parliamentary elections, Prime Minister Narendra Modi has contracted the country’s budget deficit and passed laws to ease foreign investment in some sectors. Pledges to extend spending on infrastructure and scale back reduce resonate with the country’s individual investors, who expect quicker economic growth to guide to stock-market gains.

Indian institutional investors, together with mutual funds, insurance corporations and banks, poured just over 200 billion rupees (about $3.13 billion) into the stock market in April and May, the biggest net flow over a two-month amount since 2008. The inflow of money from domestic investors will be one of the biggest things in the upcoming 5 or 10 years.

Image by Clker-Free-Vector-Images from Pixabay (Free for commercial use)

Image Reference: https://pixabay.com/fr/vectors/graphique-stock-vers-le-bas-crash-36929/

Leave a Reply