Tips For Effective Money Management

Why is it important to have a solid and stable personal financial situation? What does that even mean: personal finance, or money management? Don’t you need to be wealthy first, before it pays to think about those things?

Just a few questions that might pop up once you start thinking about money and how to deal with it. The answers to those questions are not even that hard to come up with, if you put your mind to it.

Being able to manage your money in an effective and responsible way is important for anyone and everyone, at virtually anytime. Of course it also helps to understand what money is, exactly.

Whether you are trying to make ends meet as a single mother on social welfare or you are a cash-loaded billionaire, if you do not know the rules of personal financial management and how to apply them, sooner or later you are destined to run into serious financial problems. Don’t forget: in the end, it’s all about your personal happiness.

Set Smart Financial Goals

By composing a smart goal, you can increase the effectiveness of the financial goal setting process. Smart is an acronym that stands for Specific, Measurable, Attainable, Realistic and Time sensitive. By making sure that your goals have these characteristics, you make them more effective.

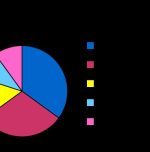

Analyse Your Spending

You can’t effectively plug holes through which you are losing money unless you know where these holes are. To help yourself make wise financial choices, look through your credit card statement or keep receipts from your shopping trips. Create a list of categories to represent your spending patterns.

Write down how much you spend in each category each month, and add up your total. If you notice that one category seems a little bloated, consider ways in which you could reduce the amount of money you are spending on that type of good or service.

Use Cash Over Credit

It is easy to overspend when using a credit card. If you find that you swipe away with abandon, retire your credit cards and opt instead to an old-fashioned stack of cash. By visiting the ATM at the start of the week and taking out a set sum of money, you can more easily monitor how much you spend during the week.

Create an Emergency Fund

As you set up your new household, dedicate yourself to creating an emergency stock-pile of cash. By setting aside some cash for things like an unexpected car break-down, a pipe rupturing or an emergency medical expense, you can avoid turning to credit and instead pay for these little extras with saved cash.

Decide on an Amount to Save Monthly

It is easy to put off the task of saving until next month. To avoid forever putting off starting that savings account or beginning your investment portfolio, commit yourself to setting aside a certain amount of money each month. Decide upon a figure with your spouse, and work together to ensure that you meet this set figure.

Photo by Darío Martínez-Batlle on Unsplash (Free for commercial use)

Image Reference: https://unsplash.com/photos/c4JgIGUmpB8

Leave a Reply