Leveraging gifted money to boost your credit score

Gifted money doesn’t directly affect your CIBIL score; however, its judicious use can certainly enhance your creditworthiness.

Managing these funds wisely can have a positive impact on your financial health and, indirectly, on your credit score.

Here’s how you can use gifted money to your advantage:

Utilizing gifted money to settle outstanding debts, such as credit card balances or loans, can be highly beneficial.

This reduces your credit utilization ratio—a key factor in credit scoring—thus boosting your score.

Furthermore, clearing debts demonstrates responsible financial behaviour to creditors.

Depositing gifted money into savings or investment accounts helps build your financial buffer. This increased stability can assist in managing unforeseen expenses.

In addition, it also reduces the need to take on high-interest debt during emergencies. While this does not directly influence your credit score, it supports sustained financial management which is favorable for long-term creditworthiness.

Using gifted funds for down payments on major purchases like homes or cars can indirectly improve your credit score.

This is because making a substantial down payment often leads to lower loan amounts and potentially better loan terms, which are easier to manage and repay on time.

It’s crucial to remember that merely keeping the gifted money in your account without active financial management won’t impact your credit score. How you utilize these funds plays a critical role in shaping your credit health.

Here are some important points about the credit score:

- Checking your credit score annually is recommended. This helps track your financial health and catch any discrepancies early.

- Errors in credit reports can occur. Regular checks enable you to identify and rectify mistakes such as incorrect account reporting or personal information errors.

- Timely payments, maintaining a diverse mix of credit accounts, and managing debt levels effectively are crucial for a good credit score.

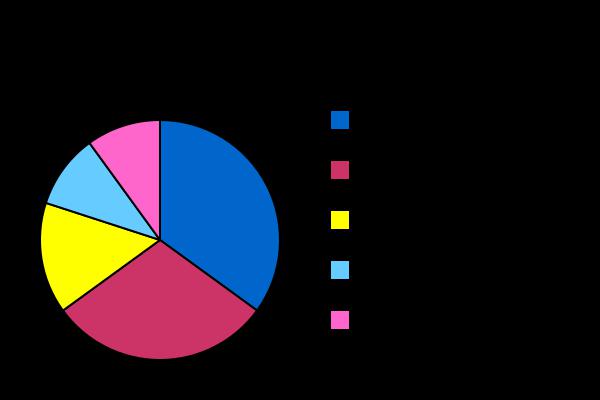

- A credit score is based on factors like your payment history, credit accounts, outstanding debts, length of credit history, and recent credit inquiries.

Effectively managing gifted money can make a significant difference in your financial portfolio and credit score, paving the way for better financial opportunities.

Image Credit: User:Pne, CC BY 2.0, via Wikimedia Commons

Image Reference: https://commons.wikimedia.org/wiki/File:Credit-score-chart.svg

Leave a Reply