Safe Investment Options

Many investors are interested in safe investments. Safe investments make sure you don’t lose your capital. This is the reason many chose not to invest in risky instruments like equities, equities mutual fund.

When you are investing, here are certain things you need to consider. Look at the Investment Horizons, Liquidity, and Taxation. Here are some of the best safe investment instruments available in India.

Bank Fixed Deposits

Bank fixed deposits are probably the most common financial instrument invested in. The interest gained on these investments tend to range from 6.6 to 7.5 per cent depending on the bank. The returns you gain on these deposits are taxable based on your tax slabs. If it exceeds Rs. 10,000 in a year, then it will be taxed as per tax slabs.

Recurring Deposit

Recurring deposits are also very common. They give investors regular monthly income. It is good for savings as well. TDS is also applicable on interest on recurring deposits now. Just like with bank deposits, TDS is applicable for sums of over Rs 10,000.

Public Provident Fund

Public Provident Fund (PPF) is a favorite among many conservative investors. It has many advantages. The interest gained on PPF is not taxable. You will also get tax benefits under Sec 80C of the Income Tax Act. This makes it useful for retirement funds.

Monthly Income Scheme

Monthly income scheme is by post office. It is a low risk option with decent returns. It is quite common for senior citizens or retired employees.

Sukanya Samriddhi Account

Sukanya Samriddhi Account is made for promotion of girl child education. It can be opened at post offices and commercial banks. The account also offers tax benefits under Sec 80C of the Income Tax Act.

Debt Mutual Funds

Debt mutual funds have the advantage of giving you higher returns than bank deposits. This is because, some of the money is parked into equities.

Image by Tumisu from Pixabay (Free for commercial use)

You may also like

Image Reference: https://pixabay.com/fr/photos/investissement-la-croissance-5299600/

Recent Posts

- NIRDPR announces faculty, staff vacancies in HyderabadInterested candidates can apply through the official portal before 08 March 2026.

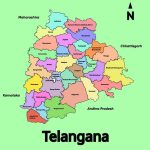

- Telangana’s ₹6,000 crore salary surge sparks debateTelangana’s relatively strong economy has allowed timely salary disbursals.

- From kitchen wisdom to airport shelves: The rise of Mama NourishMama Nourish offers 12 variants, including a Mini Laddubar for post-meal cravings.

- NIRDPR announces faculty, staff vacancies in Hyderabad

What’s new at WeRIndia.com

News from 700+ sources

-

Rubio to embark on two-day Israel visit on March 2

-

In Friday sermon, Mirwaiz expresses concern over worrying situation in Palestine, Iran, Afghanistan

-

Critically endangered Sumatran elephant calf found dead in Riau

-

Bill Clinton Denies Wrongdoing in Epstein Ties Amid Scrutiny

-

Satellite images show more aircraft at Saudi airbase used by US forces

-

Afghan forces strike Pak nuclear facility, military base near Abbottabad, amid escalating clashes

-

WeRIndia – A News Aggregator

Visit werindia.com for all types of National | Business | World | Politics | Entertainment | Health related news and much more..

Leave a Reply