Mistakes to avoid making on Your Tax Return

Numerical mistakes are one of the main causes for filing a tax return and the first thing that the IRS will check.

The long rows of numbers can mind-numbing, not to mention confusing, making it simple for you to mess up a number or two.

Unfortunately, these pure blunders can bring about owing more cash than you should or a reduced refund. Check your numbers and check them twice.

But rather than math mistakes there are much more mistakes we should keep in our mind.

There are almost 1,000 different IRS tax forms, add that to filing taxes for the first time as a small business owner, and you have a recipe for genuine anxiety.

Keep these mistakes in mind throughout the entire year so when tax season comes around you’re less stressed and better arranged:

Filing a paper tax return form

It’s anything but difficult to bungle fundamental math or neglect to sign your name when you document your assessments on paper. But you don’t have to shell out a lot of money for a fancy tax software program or hire a CA to up your chances for a filing a flawless return. Simply e-file on the IRS website.

The computer program wipes out math errors, makes simple to include additional forms, and won’t let you record without putting in a PIN signature.

Picking the wrong filing status

There are five filing statuses: Single, Married Filing Jointly, Married Filing Separately, Head of Household and Qualifying Widow(er) with Dependent Child. You’re recording status is utilized to decide your standard finding, qualification for specific credits, and at last your right duty.

But more than one filing status can apply to you and that can be confusing. If you aren’t sure about your filing status, don’t leave it to chance—or a kick-backed return.

Track your health savings account commitments

A lot of times, people make commitments to their health savings accounts one time in the year and then forget to take it as a deduction on the tax return.

If you have a health savings account, you’re probably aware of its three major tax advantages. Your contributions are tax-deductible and are done with pre-tax money if you make them via payroll. Your savings will grow free of taxes, and you can pay for qualified medical expenses on a tax-free basis, as well.

Taxpayers often forget to make note of their contributions to these accounts, which may mean they’re missing out on a tax deduction.

Being too aggressive with deductions

For most taxpayers, the big three deductions are related to mortgage interest, charitable contributions or medical expenses. But too often, people listen to what other people or friends are claiming and they think they can do the same. You are not allowed deductions without substantiation.

If you don’t have proper receipts and records, you run the risk of the IRS auditing you, and then ending up with an additional tax liability. Always seek professional assistance when in doubt if a deduction is legitimate, or if you need help determining whether you should itemize or take the standard deduction.

Combining your business and personal expenses

This mistake will make tax season a lot more complicated than it needs to be. Running your personal expenses—like medical bills, groceries, etc.—through your business is a major red flag for the IRS.

It’s best you have a totally separate business account and refrain from using your business card for any personal matters. If you haven’t yet, do this now, or as soon as possible.

Filing late

Try not to going to make the April 15 deadline? Prepare to horse up more cash. If you file late and owe tax, you will get hit with penalties and interest. For failure-to-file, the penalty is 5 percent for each month your tax return is late, up to a total maximum penalty of 25 percent.

The failure-to-pay penalty is 0.5 percent of the amount of tax you owe for each month the tax is not paid in full. And you’ll also have to pay interest for every month you don’t pay in full.

Avoid late filing penalties and fees by filling for an extension. Just be aware that an extension of time to file is not an extension of time to pay.

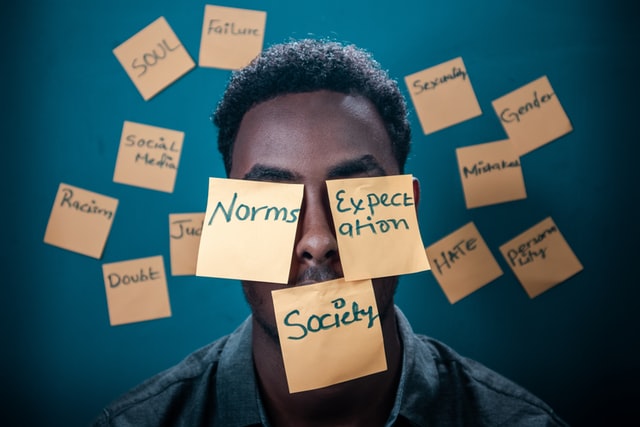

Photo by Yasin Yusuf on Unsplash (Free for commercial use)

Image Reference: https://unsplash.com/photos/fMh-VTuMHQs

Leave a Reply