Credit score myths busted: What really matters

Credit scores play a key role in financial decisions. Yet, many people still believe common myths that can hurt their credit health.

Knowing the facts is the first step toward making smarter financial choices.

Myth 1: Checking your credit report lowers your score.

Fact: This is false. When you check your own credit, it’s a soft inquiry. Soft inquiries do not impact your score.

Myth 2: Income affects your credit score.

Fact: Your income has no direct impact. What matters is how you use and manage your credit. Payment behaviour, not salary, drives your score.

Myth 3: More credit accounts mean a better score.

Fact: Applying for many accounts in a short time can lower your score. Each application creates a hard inquiry, which may reduce your score slightly.

Myth 4: Closing old credit cards helps your score.

Fact: Length of credit history affects your score. Closing older accounts shortens that history and can hurt your credit profile.

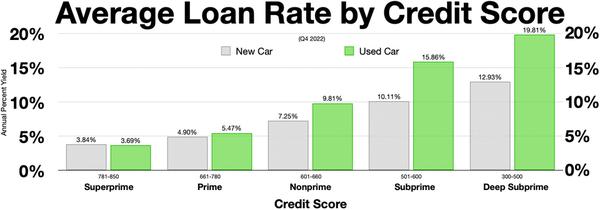

Myth 5: A low score means no loan approval.

Fact: Lenders look at more than just your credit score. You may still get approved, though possibly with stricter terms or higher interest.

The following factors affect your credit score:

- Payment History: Late or missed payments damage your score. Always pay on time.

- Credit Utilization: Keep credit use below 30% of your limit. Lower is better.

- Length of Credit History: Longer history shows stable and responsible use of credit.

- Credit Mix: A variety of credit types shows good credit handling skills.

- New Credit: Too many new accounts can suggest financial stress and may lower your score.

Misunderstanding credit scores can lead to costly mistakes. By knowing the truth behind these myths, you gain more control over your financial well-being.

Focus on proven factors like timely payments, low credit use, and long credit history. Credit health is built over time, with consistent and responsible habits.

The more informed you are, the stronger your credit and financial future will be.

Image Credit: Wikideas1, CC0 1.0, via Wikimedia Commons

Image Reference: https://commons.wikimedia.org/wiki/File:Average_loan_rate_by_credit_score.webp

Leave a Reply