Building a strong credit score: A smart start for first-timers

Stepping into the world of financial independence is exciting, and building a strong credit score early on can make a huge difference in shaping your future.

Your credit score is a three-digit number that reflects how responsibly you manage borrowed money.

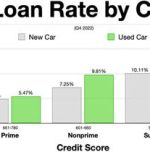

For a first-timer, this score can open doors to better loan options, higher credit limits, and lower interest rates in the future.

To begin building your credit history, start small and stay consistent. One of the simplest ways is to apply for a consumer durable loan; for example, by purchasing a smartphone on EMI.

Successfully repaying even small loans on time builds a positive repayment track record.

Another easy method is using the Pay Later option on e-commerce sites. This facility is treated like a credit line and helps create your credit footprint.

If you have a salary account, applying for a credit card from the same bank increases your chances of approval.

Another smart move is opting for a secured credit card against a fixed deposit. These cards are easier to obtain and offer a great way to build your CIBIL score safely.

Once you access credit, responsible usage is the golden rule. Use just one credit card initially and pay the full bill before the due date to avoid heavy interest charges and maintain a clean credit report.

Regularly monitor your CIBIL score and report to track your progress, catch errors early, and protect yourself from identity theft or wrongful reporting.

But why go through all this effort? Because a good credit score is not just about loans.

It plays a role when you want to buy your first home, start a business, get a car loan, or even secure better job opportunities where financial trustworthiness matters.

Remember, credit is a long-term game. Building a strong score early creates a foundation for smoother financial experiences later in life.

Stay disciplined, borrow smartly, and treat your credit history like an asset, because one day, it will open up possibilities you can’t even imagine today.

Image from Pxhere (Free for commercial use / CC0 Public Domain)

Image Published on March 14, 2017

Image Reference: https://pxhere.com/en/photo/1136512