Why good credit scores alone can’t guarantee a loan

A credit score of 750 or higher is often seen as a green light for credit approvals.

However, having a good credit score doesn’t always ensure that your credit card or loan application will be accepted. Several additional factors influence the decision.

Know why your credit application may still be rejected and how you can address these issues.

Key Reasons for Rejection

Restricted City of Operation

Some banks and NBFCs operate only in specific cities. For instance, HSBC’s Live+ Credit Card is offered only in selected cities like Chennai, Mumbai, Delhi NCR, and Hyderabad. Your application could be declined regardless of your credit score if you reside outside these locations.

Income or Age Mismatch

Banks specify minimum income criteria for both salaried and self-employed individuals. For example, HDFC Bank’s Freedom Credit Card requires a net monthly income of ₹12,000 for salaried individuals, while self-employed applicants must show an annual ITR of ₹6 lakhs. Failing to meet these benchmarks can lead to rejection.

Frequent Job Changes

If you frequently switch jobs, lenders may perceive you as financially unstable. Banks prioritise applicants with stable careers, as regular income ensures timely repayment of EMIs.

High Debt-to-Income (DTI) Ratio

A high DTI ratio significantly reduces approval chances, indicating that more than 50% of your income is used to repay debts. Banks generally prefer a DTI ratio of 35% or lower for personal loans.

KYC Document Issues

Missing or incorrect KYC documents, including identity and address proofs, can lead to outright rejection of your application.

Too Many Applications

Applying for multiple credit products in a short period signals credit-hungry behaviour. Each application triggers a hard inquiry, temporarily lowering your credit score and decreasing your chances of approval.

How to Improve Approval Chances

- Ensure your city of residence matches the bank’s service locations.

- Meet the income and age criteria by researching the requirements beforehand.

- Maintain job stability to project financial reliability.

- Keep your DTI ratio low by minimizing debt obligations.

- Submit complete and accurate KYC documents.

- Space out credit applications to avoid hard inquiry penalties.

By addressing these factors, you can increase the likelihood of your credit applications being approved while maintaining a strong credit score.

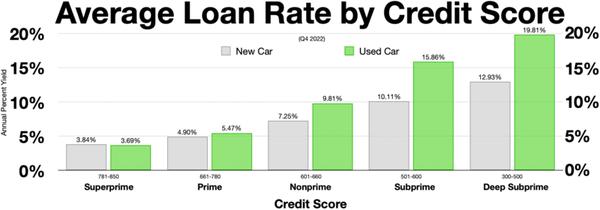

Image Credit: Wikideas1, CC0, via Wikimedia Commons

Source: Own work https://www.nerdwallet.com/article/loans/auto-loans/average-car-loan-interest-rates-by-credit-score

Image Reference: https://commons.wikimedia.org/wiki/File:Average_loan_rate_by_credit_score.webp

Leave a Reply