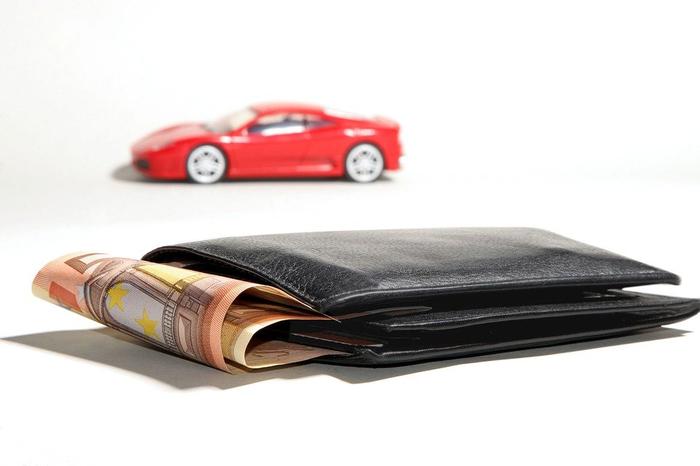

Types of car loans

Banks provide loans to buy a new car. Banks offer loans for used cars also. In addition to that, they give loans against cars as well.

Here are the details about these three types of car loans:

Loan for a new car: Banks disburse a higher amount to buy new cars than for used cars due to lower risk. The interest rate is also low. A borrower can get a loan of up to 90 per cent of the cost of the car. Eligible borrowers can even get up to 100 per cent. Currently, many banks offer various types of loans at a low rate of interest. It varies with each bank ranging from 7 to 9 per cent. The tenure varies between five and seven years. However, you have to pay huge money initially to buy a new car. Also, the total outflow of cash increases due to the payment of the insurance premium.

Loan for a used car: Banks fund lower amount to buy used cars. The loan amount depends on the age and condition of the car. The interest rate is also high on used car loans. As per the rules of many banks, the car’s age should not exceed 10 years at the time of maturity of the loan. Hence the repayment tenure will be four to five years as per the age of the car. The initial cost of a used car is lower than that of a new car. Similarly, the cost of insurance premium is also low.

Loan against the car: If you need funds, you can obtain a loan against your car. That means you can use your car as collateral and get the funds instantly into your account. You can get 100 per cent of the value of the car. But, the interest rate is higher on these loans. Banks levy different charges like document charges, collateral charges etc.

Image by andreas160578 from Pixabay (Free for commercial use)

Image Reference: https://pixabay.com/photos/auto-financing-financing-interest-2157347/

Leave a Reply