Tips to improve loan approval chances

While approving a loan to an applicant, a lender considers several factors. These factors play a crucial role in improving your chances of loan approval.

Here is a list of those factors:

- Keep your monthly expenses to income ratio lower. Your income should be more than your monthly expenses, that means your spending should not exceed 50 per cent of your income. It improves loan approval chances as the lender considers that you can easily repay EMIs.

- Maintain a good amount in your bank account.

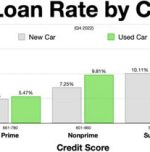

- Your credit history reveals your financial discipline. The lenders check your past loans and any other credit in the form of overdraft or credit cards, and how you repay them. Make the payments of utility bills on time as it may hurt your credit score.

- The proportion of total permissible credit limit used by a cardholder is called a credit utilization ratio. As per financial experts, the ideal ratio is 30 per cent. That means if you have a credit limit of ₹1 lakh per month for a credit card, then your spending should not exceed ₹30,000 for a good credit score.

- Two types of loan enquiries, soft and hard are there. If you call or approach the bank directly, then it is known as a hard enquiry. The lender generates a credit report to find out your creditworthiness. If your credit report is pulled by more number of lenders, then there will be more chances of hurting your credit score.

- Hence, you can proceed with a soft enquiry. There are many ways including check your eligibility using a loan rate comparison platform.

- Taking too many loans at a time is not a good idea as it reduces your loan approval chances.

- Do not switch off the jobs too frequently. Lenders perform a background search on your employer and also your job stability to repay the loan.

Image by Clker-Free-Vector-Images from Pixabay (Free For commercial use)

Image Reference: https://pixabay.com/vectors/approved-stamp-approval-quality-29149/

Leave a Reply