Simple ways to improve your credit score

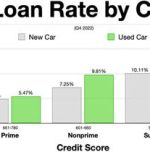

Credit score is a very important factor when it comes to finance matters. Buying a house or car is very dependent on it if you want a proper loan. It is important to maintain a good credit score as it used by financial institutions to make a guess about you. Here are some important tips to follow to improve your credit score.

Check your credit report

Credit score can be improved from your credit report. Check any errors that you can find in the credit report by asking for a free copy. Make sure there are no late payments incorrectly listed.

Pay bills regularly

Your history of paying bills will impact your credit score by almost 35 percent. Maintain good consistency in paying bills and be on time.

Clear a debt

When you have a debt, it will automatically reduce your credit score. So, it is obvious that clearing a debt will improve your score.

Reduce credit card usage

The name credit card should be sign enough that it will affect your credit score. Reduce number of credit cards you have and minimize usage to 10-20 percent of total credit.

Credit card default should be reduced

Make sure you keep balance due of each credit card to at least below 30 percent of the credit limit.

Image by Clker-Free-Vector-Images from Pixabay (Free for commercial use)

Image Reference: https://pixabay.com/fr/vectors/de-cr%C3%A9dit-rapport-banque-score-40671/

Leave a Reply