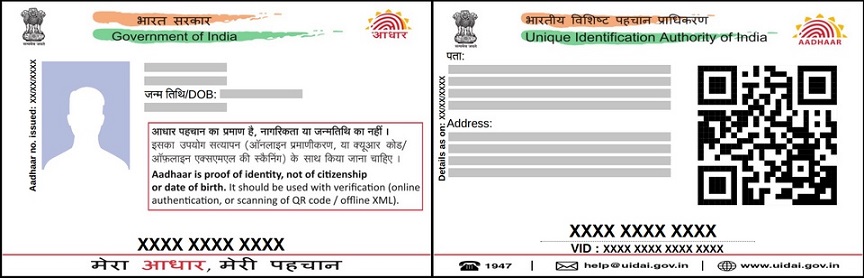

PAN-Aadhaar linking: Clear rules, limited exemptions

As regulatory enforcement tightens, taxpayers must understand where they stand. PAN–Aadhaar linking directly affects tax filings and financial transactions.

However, the requirement is not universal, and the law allows defined exemptions.

For most individuals, linking PAN with Aadhaar is mandatory. Still, the Income Tax Act excludes certain categories.

Non-resident Indians who are not treated as residents for tax purposes are exempt.

Individuals who do not possess an Aadhaar number and those specifically notified by the government also fall outside the requirement.

Age and location-based exemptions further reduce the scope. Super senior citizens aged 80 years or above are not required to link PAN with Aadhaar.

In addition, residents of Assam, Meghalaya, and Jammu and Kashmir continue to enjoy exemption under existing rules.

A crucial condition often misunderstood relates to Aadhaar applicability. PAN-Aadhaar linking is compulsory only when Aadhaar enrolment is mandatory.

Therefore, if Aadhaar is not required in your case, the PAN does not become inoperative for non-linking. This provision mainly benefits certain NRIs and exempt residents.

However, the rule changes once Aadhaar is issued. Even voluntary Aadhaar enrolment makes PAN-Aadhaar linking compulsory. Failure to link in such cases can lead to the PAN becoming inoperative.

Joint financial arrangements demand individual compliance. In joint bank accounts, demat accounts, or investments, each PAN holder must link Aadhaar separately.

If one PAN becomes inoperative, transactions linked to that PAN may face restrictions.

Minors follow a separate timeline. PAN allotted to minors does not require immediate linking. The obligation begins once the individual turns 18 and Aadhaar becomes applicable.

The law also excludes deceased individuals. PAN-Aadhaar linking is not required after death.

Legal heirs are not responsible for linking, although surrendering the PAN is advisable to prevent future issues.

Section 139AA governs these rules. It applies to individuals holding PAN as of July 1, 2017, who are eligible for Aadhaar.

Non-compliance can render PAN inoperative and may attract a late fee of ₹1,000.

Understanding exemptions and acting on time ensures uninterrupted financial compliance.

Image Credit: SayantanDhara, CC BY-SA 4.0, via Wikimedia Commons

Image Reference:

https://commons.wikimedia.org/wiki/File:Specimen_of_an_Aadhaar_Card_2024.png