New Income Tax Regime Vs Existing Tax Regime

Finance Minister Nirmala Sitharaman proposed a new income tax regime for the financial year 2020-21 saying that the tax structure would be simple to the taxpayers.

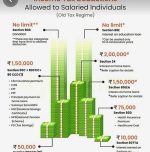

Under the new tax regime, tax rates were slashed. However, under the new income tax regime, one would have to forego certain exemptions and deductions.

One can opt between the existing tax regime and the new tax regime. In this context, it is apt to know whether the new income tax regime really benefits the salaried class.

If the income is ₹10,00,000, then the taxable income under the existing tax regime would be as follows:

Income ₹10,00,000

Deductions under sec 80C ₹1,50,000

sec 80D ₹25,000

Home loan ₹2,00,000

Standard deduction ₹50,000

Then the taxable income would be ₹5,75,000

The tax payable is calculated as follows:

Up to ₹2.5 lakhs there is no tax.

Up to ₹5 lakhs @5%, the tax would be ₹12,500

Up to ₹7.5 lakhs @20%, the tax would be ₹15,000 (₹75,000 x 20/100)

Then, the total tax payable would be ₹25,500.

On the other hand, if you opt for the new tax regime, the tax payable would be as follows:

Since no deductions are allowed under the new tax regime, the total taxable income would be ₹10,00,000.

And the tax payable would be calculated as follows:

Up to ₹2.5 lakhs there is no tax.

Up to ₹5 lakhs @5%, the tax would be ₹12,500

Up to ₹7.5 lakhs @10%, the tax would be ₹25,000

Up to ₹10 lakhs @15%, the tax would be ₹37,500

Then, the total tax payable would be ₹75,000.

Hence, tax consultants and financial experts suggest that, if you have certain deductions and home loan to reduce your taxable income, then the existing tax regime would be better. On the other hand, if you do not have any such financial instruments, then the new tax regime is better.

The new tax regime is easy for those who started their career just now and do not have any investments or home loan. Since it is easy to use, one can file without the help of a tax professional.

On the other hand, if you have any investments or a home loan or complex salary structure, then the existing tax regime will be beneficial.

As per the opinion of many tax professionals, the existing tax regime is beneficial for those earning below ₹12 lakhs and obtaining tax deductions of ₹2 lakhs while the new regime would be beneficial for those earning above ₹13 lakhs.

Image by Bruno from Pixabay (Free for commercial use)

Image Reference: https://pixabay.com/photos/euro-seem-money-finance-piggy-bank-870757/

Leave a Reply