Consequences of late income tax return filing

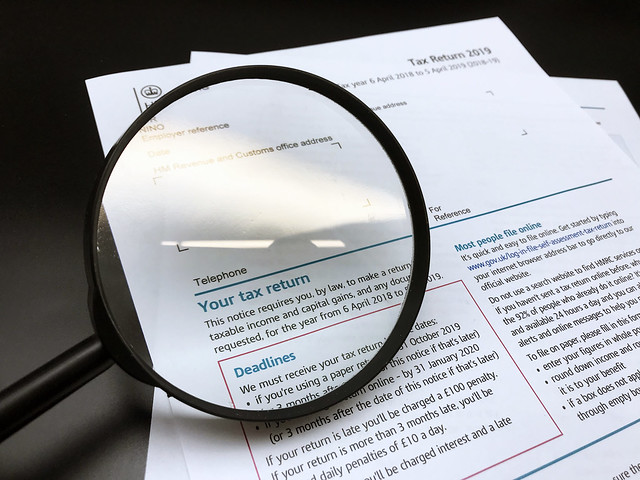

Filing income tax returns happens every year. The last date for doing this is July 31. The government could extend this date based on the situation. This is extended till August 31 this year. It is generally a good idea to file the return on time. Many people suggest submitting it much earlier than July 31 as it can help you receive your refund early. If you file them late, this is what could happen.

If you file tax returns late after the stipulated time frame, then you will face an interest. The rate of interest is one percent per month. The interest may not be applicable to people who have paid advance tax.

If you pay your advanced taxes beyond the date of July 31, you won’t be able to carry forward losses.

It is an important fact to know that you have to pay your advance tax, if your TDS is not being deducted. For example, if you have significant incomes, then the government would lose by collecting income tax money just at the end of the year.

You should also know that the longer you take to file your tax returns, the longer the income tax department would take to process your refund.

If you file your tax returns late, you may not have an opportunity to rectify the mistakes if any in them. So, file them by the due date i.e. August 31, 2015.

Image Credit: dpp-businesstax.com / CC BY 2.0

Image Reference: https://www.flickr.com/photos/162663273@N06/48232718842

Leave a Reply