Benefits of knowing the CIBIL Score before a loan

Credit score is important to avail a loan from banks. Credit Information Bureau (India) Limited (CIBIL) provides credit score ranging from 300 to 900 to individuals. CIBIL score reveals the credit worthiness and credit history of the borrowers. Higher score means low-risk customers while lower score indicates risky customers and defaulters.

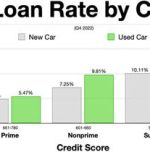

If you have a higher credit score, then you will get loans easily at lower rate of interest. Based on your eligibility, you can even get a higher loan amount.

You can get free CIBIL report once a year as per the rules of the RBI. You have to pay the prescribed fee after that to get your CIBIL score. You can get CIBIL score by registering with cibil.com by providing the essential details like email id, date of birth, PAN etc.

Normally, a credit score of 750 and above is considered good to get a loan from the banks. The higher the credit score, the more the chances of approval of your loan.

If you know your credit score or CIBIL score, you will have many benefits mentioned as below:

- If you know your credit score, then you can apply for a loan without a fear of rejection from the bankers.

- Based on your score, you can decide whether to approach a bank or NBFCs. If you have a lower credit score, then banks might not approve your loan. In that case, you can avail a loan from NBFCs. So, knowing your credit score beforehand will save your time as you can directly approach NBFCs rather than approaching a bank and get rejected by them.

- You can negotiate with bankers on the terms like waiving off processing fee, if you know that you have a good credit score.

- You can also get a loan at a lower interest rate. Knowing your credit score before applying a loan helps you save the interest amount as you can request banks for lower interest rate.

- You can also avoid loan rejection from the banks if you know your credit score. If you have a lower score, you can wait for some time to improve it and seek a loan later.

Image by Clker-Free-Vector-Images from Pixabay (Free for commercial use)

Image Reference: https://pixabay.com/vectors/credit-report-score-bank-banking-40673

Leave a Reply