Myths about Credit Score

Credit score is one of the most vital aspects for the customers to avail loans from the banks and financial institutions. It is a three-digit number which reveals the creditworthiness of a user.

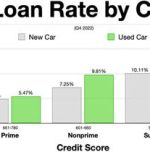

This score helps lenders analyze the ability of customers to repay the loan. The credit score above 720 is considered a good score and helps get loans easily from banks. Score under 300 is considered very poor.

Your credit score is affected by many factors like credit utilization, repayment of loans, credit history, and type of loan.

There are many myths associated with the credit score.

Some of them are mentioned below:

- Some people think that their income impacts the credit score. But, it is a myth. Even if a consumer has a high income but does not have discipline in repayment of loans, they may have a lower credit score. On the other hand, people who have lower income and repay on time can have a higher credit score. So, it is not the income, but the timely repayment impacts your credit score.

- Some others believe that not taking loans can improve their credit score. But if you do not have a loan, then how would you have a credit history to evaluate your credit score? Having no loans cannot help the lender to analyze your credit behaviour.

- It is another myth that having multiple loans will improve your credit score. Multiple loans and multiple credit enquiries can impact your credit score adversely.

- If you have multiple credit cards, then there is a higher chance of default due to multiple payment dates and bills. So, your credit score will be impacted negatively. Moreover, you may appear risky to lenders if you have multiple cards even though you do not use some of them.

- Another myth is that repaid debts would not reflect on the credit report. But, it is not true. All existing and closed loans in the last two years will reflect on the credit report.

So, repay your loans on time to get a good credit score and keep track of your credit report from time to time.

Image Credits : Nick Youngson CC BY-SA 3.0 Alpha Stock Images

Image Reference: https://picpedia.org/handwriting/c/credit-score.html

Leave a Reply