Linking Aadhaar and PAN with name mismatch

Aadhaar card has been made mandatory for income tax. It has to be linked with the Permanent Account Number (PAN) by July 31 to pay tax.

Due to this sudden move to cut down tax frauds, many issues arose. One of the biggest problems in this is mismatch of name.

Your name could be spelled differently or have initials in one and spelt fully in another. This mismatch makes it hard to do the linking process.

Here is how to solve the problem and link PAN with Aadhaar Number.

The first thing you have to do is apply for a name change.

You need to get a scanned copy for PAN for this purpose. With the scanned copy, go to the Aadhaar website and request for a change in the name there.

There, you will be verified using a one-time password on the phone number registered with the Unique Identification Authority of India (UIDAI).

Use this OTP to change the name on your Aadhaar. This is beneficial for many women who changed their surnames after marriage. The OTP will be sent to their Aadhaar registered mobile number.

Furthermore, the tax department is also looking to start an option which allows citizens on the e-filing portal to link the Aadhaar without changing the name by opting for a One-Time Password (OTP). For this to work, the year of birth of the person should match in both documents. This option might come soon.

Be aware that spelling mistakes can be quite troubling to handle. So it is recommended to correct the errors in your name quickly.

One can log on to e-filing website of the income tax department or NSDL to link Aadhaar and PAN easily. But having differently spelled names on the two cards will result in denial. Both names should be spelt the same.

If you used full name in one identification, use the same in other identifications too. This avoids future problems.

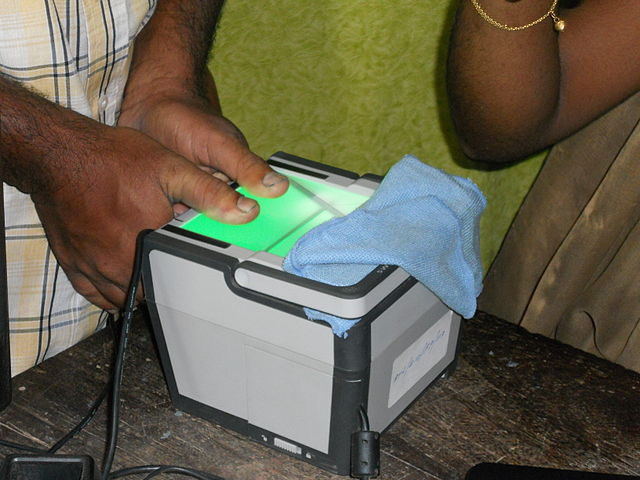

Image Credit: Kannanshanmugam,shanmugamstudio,Kollam / CC BY-SA 3.0

Image Reference: https://commons.wikimedia.org/wiki/File:Adhar_DSCN4545.JPG

Leave a Reply