Finin – Modern neobanking platform

The interest of customers in digital transactions and their growing number lead to the origin of many fintech startups and digital banks in the country.

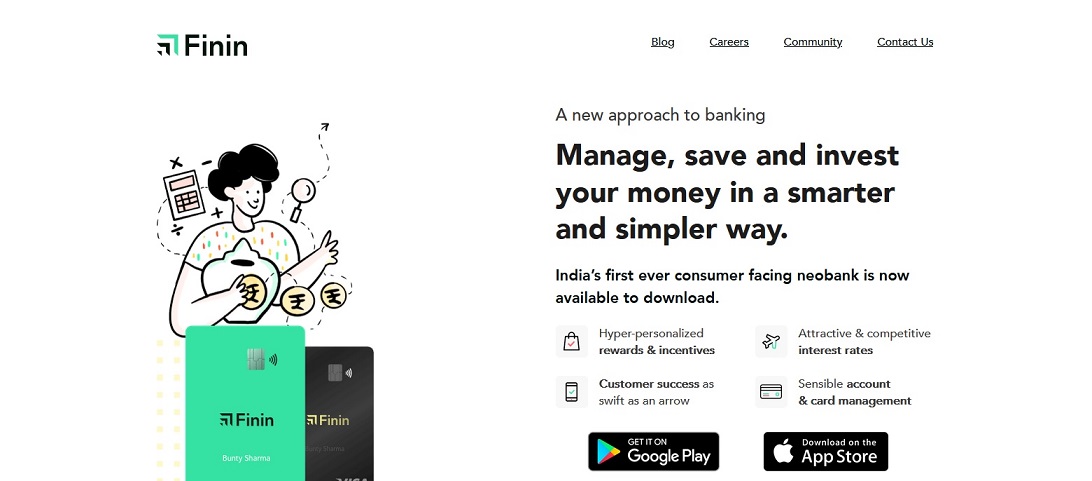

Finin is one such startup. This Bengaluru based neobank’s motto is to help you manage, save and invest your money more smartly and simply.

Finin aims to offer reimagined banking experience to their customers with customized services.

As the financial needs and requirements are different for each individual, Finin focuses on providing solutions to meet their individual needs.

Suman Gandham and Sudheer Maram launched Finin, a neobanking platform to provide comprehensive financial solutions. They started the business with ₹50 lakhs in 2019.

The duo realized that most banks in the country offer the same solutions, even though the financial needs and goals of different people are different. That means there is a need for customized and personalized services for each of them. But, most banks and fintech startups do not offer personalized services and targeted products. Hence, the duo wants to address the issue and fill the gap in this sector.

The startup provides personalized recommendations to invest and spend money wisely for better returns. These recommendations are based on the requirements of the customers.

Since Finin is a neobanking platform, one can operate it online easily. Opening a saving account with them is simple. Customers have to finish the KYC process to open an account with Finin. As soon as they open an account, they will receive a debit card. They can also link other bank accounts to this saving account. The startup has some good features like smart budgets and goals. These features enable the customers to spend and invest wisely by offering clever recommendations.

Finin has parented with SBM India. At present, around 18,000 people are using the app. The founders want to improve their customer base to one lakh users.

Image Credit: Finin Website Screenshot

Image Reference: https://finin.in/

Leave a Reply