Keep these documents ready for ITR filing

Usually, taxpayers file their income tax returns on or before 31st July of the assessment year. However, this year the government extended the deadline for income tax return (ITR) filing to 30th November.

You have to keep certain documents ready for a smooth and hassle-free return filing to avoid mistakes and corrections in your ITR.

- Form 16 is provided by employers to their employees which includes a detailed breakdown of the salary structure. Employees can verify their TDS and fill the details of their salary information in the ITR form easily using this data.

- Form 16A is also a TDS certificate which is issued on income other than salary. For instance, TDS deducted on interest earned on fixed deposits with the bank, TDS on rent receipts or insurance commission etc. While Form 16 is issued annually, Form 16A is issued quarterly.

- Form 16B is provided by a buyer to the seller of a real estate property after deducting TDS where sale consideration is ₹50 lakhs and more.

- Form 16C is provided by a tenant to landlords for TDS deductions on rent where the monthly rent exceeds ₹50,000.

- Form 26AS provides details of the TDS deducted by all who have made payments to you. It portrays all the sources of your income and the amount, and TDS deducted on such income. 26AS can be downloaded from the TRACES Website. Check the form and make sure that the amount deducted as TDS is matching with 26AS.

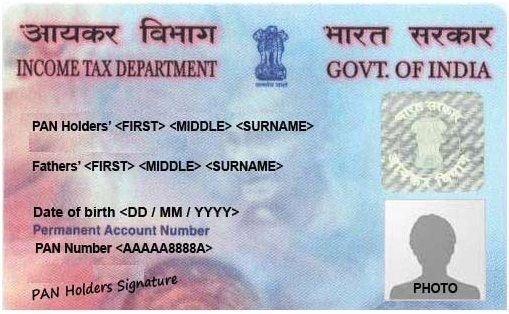

- While filing income tax returns, you must disclose the details of all the bank accounts operated by you including account number, bank name, branch and IFSC. So keep your passbooks ready. You have to link your PAN to your bank account and provide the details to get the income tax refund.

- You have to keep the proofs of insurance premium payment receipts, home loan statement, investment receipts under section 80C, 80D, and 80E, investments made in PPF and tax saving mutual funds to avail tax deductions.

- Also, keep the documents ready for capital gains like the sale of shares, mutual fund units, bonds, ETF Units, sale of property etc. These include sale and purchase deed of the property, brokerage, holding statement for shares etc.

Image Credit: PageImp / CC BY-SA 4.0

Image Reference: https://commons.wikimedia.org/wiki/File:A_sample_of_Permanent_Account_Number_(PAN)_Card.jpg

Leave a Reply