Difference between Form 16 and Form 16A

Form 16 is the TDS deduction for employees by the employers and most salaried employees are aware of it.

Do you know form 16A and what is the difference between both form 16 and form 16 A?

Here are the differences between both the forms:

- Both form 16 and 16A provide details of TDS but on different incomes.

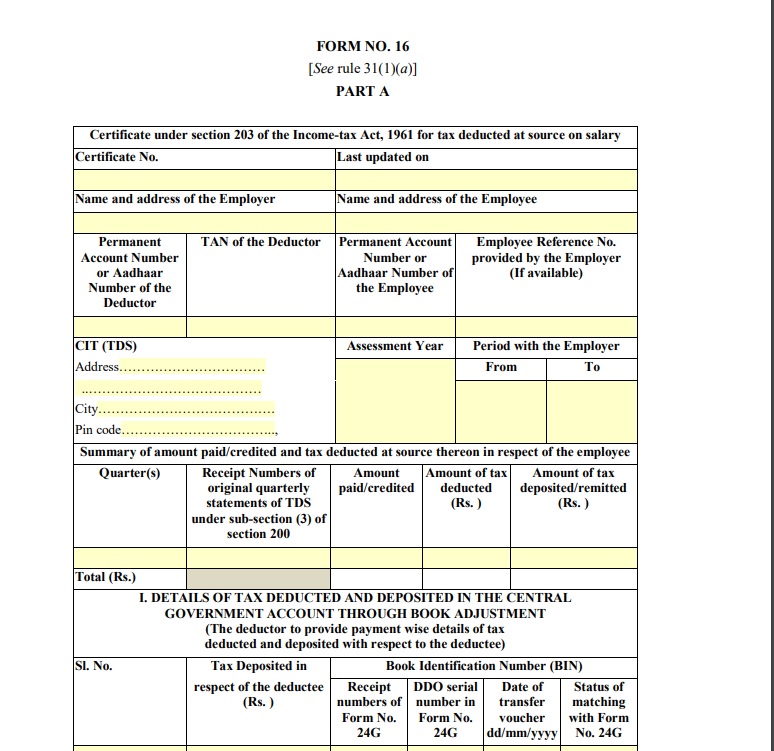

- As earlier said, form 16 gives a breakup of the taxes paid by the employer on the salaries of their employees. Employers should have to deduct TDS on the salary of their employees if it exceeds the tax exemption limit. This form has part A and part B.

- Part A of form 16 consists of the details of employee and employer like name, address, PAN, TAN etc. and the amount deducted as TDS.

- Part B of form 16 contains the details of the breakup of salary, deductions allowed etc. If you change the job in any financial year, you will receive form 16S from each employer.

- On the other hand, form 16A provides the details of TDS on the income earned other than salary. For instance, you may have earned interest through bank deposits that exceeds the tax exemption, then banks will deduct the TDS and issue form 16A.

- Contract employees will also receive form 16A from their employers which gives the details of the TDS on their income.

- Form 16A also includes the details of both the deductor and the deductee like PAN, TAN and the challan deposited for the TDS.

- You can obtain your TDS details on Form 26AS by downloading from the income tax department. You will get a separate Form 26AS for each financial year. Your date of birth is the password to download the form.

- If you think that tax has been wrongly deducted, then you can contact the respective authority.

- With all these details, you can claim a refund or pay additional taxes if any, by filing income tax returns.

Image Credit: Screenshot from incometaxindia.gov.in

Image Reference: https://www.incometaxindia.gov.in/forms/income-tax%20rules/103120000000007849.pdf

Leave a Reply