Various Government Schemes

Indian government announced various welfare schemes for different sections of the society.

Here are details of some government schemes:

A bank account under Jan Dhan Yojana is intended to provide bank services to all citizens of the country. It is the basic account with zero balance limit. It has several benefits.

Accidental insurance cover of ₹1 lakh and life insurance cover of ₹30,000 is available for these account holders. There is also an overdraft facility of ₹5,000. This account is used to avail direct benefit transfer of government schemes including subsidy on LPG cylinders.

Pradhan Mantri Awas Yojana (PMAY) is a credit-linked subsidy scheme (CLSS) which intends to provide subsidy on the interest paid on home loans. The beneficiaries are categorized into Economical Weaker Section (EWS) and Lower Income Group(LIG) Middle Income Group (MIG)1 and 2 based on their income.

Anyone that has an annual income under ₹18 lakhs per annum can avail subsidy on the home loan for their first home. In addition to that, several municipality authorities are undertaking various projects. You can check their websites.

Pradhan Mantri Suraksha Bima Yojana is intended to provide accidental insurance for the policyholders aged between 18 to 70 years. The insurance cover is ₹2 lakh for a premium of ₹12 per year.

You can pay the premium using the auto-debit option from your bank account. The accidental cover starts from June 1 and continues till May 31 of next year. In addition to the life cover, the irrecoverable loss of sight of one eye or loss of one hand or one foot is also available for an assured sum of ₹1 lakh.

Pradhan Mantri Jeevan Jyoti Bima Yojana is a term life insurance plan. The nominees of the beneficiaries can get a life cover of ₹2 lakh. People who are aged between 18 to 50 years can avail this scheme. The assurance will be terminated after the policyholder turns 55 years. The annual premium is ₹330.

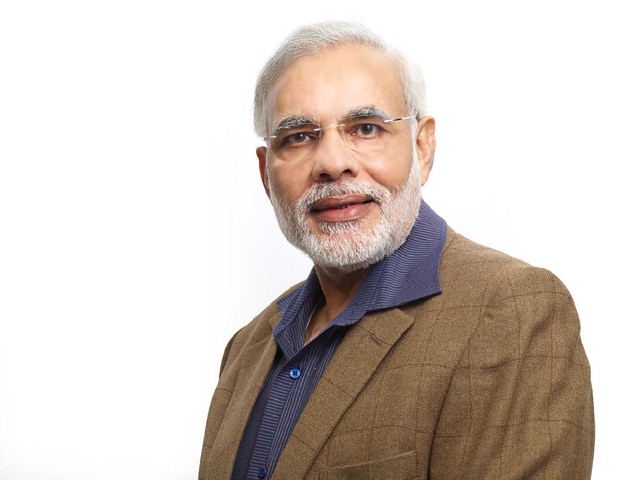

Image Credit : Narendra Modi / CC BY 2.0

You may also like

Image Reference: https://secure.flickr.com/photos/narendramodiofficial/9191758848/

Recent Posts

- Social Intelligence: Connecting with confidenceSocial intelligence focuses on reading people, responding with care, and building trust.

- Credit card fraud: How to stay smart and secureMany customers try to increase their credit card limit to enhance their purchasing power.

- SBI opens applications for Specialist Cadre PostsSBI will follow a structured selection process for these vacancies.

- Social Intelligence: Connecting with confidence

What’s new at WeRIndia.com

News from 700+ sources

-

Opinion: Opinion | IndiGo Crisis Is What Happens When Market Power Becomes Market Arrogance

-

Caught On Camera: Goa Nightclub In Full Party Mode, Then Deadly Fire Began

-

Parliamentary Panel To Summmon Airline Executives, Regulator Over Flight Disruptions

-

Any kind of threat or intimidation to individual or party will not be tolerated: Tripura CM Manik Saha

-

Trinamool’s Muslim Vote Bank Will Be Finished: Suspended MLA Humayun Kabir’s Warning

-

Hyderabad: Two Youth Killed in Road Accident at Lalapet

-

WeRIndia – A News Aggregator

Visit werindia.com for all types of National | Business | World | Politics | Entertainment | Health related news and much more..

Leave a Reply