Positive Pay System, a shield against cheque fraud

Cheque fraud is a growing concern for both individuals and businesses in India.

To tackle this issue, the Reserve Bank of India (RBI) introduced the Positive Pay System (PPS) in 2021.

This innovative mechanism enhances cheque security and ensures safer transactions, particularly for high-value cheques.

The Positive Pay System is a fraud detection measure designed to safeguard cheque transactions worth ₹50,000 and above.

It requires customers to electronically share key cheque details, including cheque number, date, payee name, account number, and amount, with their bank before presenting the cheque.

This step enables banks to verify the authenticity of the cheque when it is deposited.

It works in the following way:

- Issue a Cheque: Use PPS for cheques valued at ₹50,000 or more. It is mandatory for amounts exceeding ₹5 lakhs.

- Submit Details: Share the cheque’s details with your bank through online banking, mobile apps, SMS, or by visiting a branch.

- Verification: When the cheque is presented, the bank cross-checks the provided information.

- Approval or Flagging: If the details match, the cheque is processed. Discrepancies trigger an alert, preventing fraudulent transactions.

Why Use Positive Pay?

The system offers several benefits:

- Fraud Prevention: It significantly reduces risks associated with altered or fake cheques.

- Increased Security: Adds a layer of protection for your financial transactions.

- Faster Processing: Ensures quicker clearance by resolving discrepancies early.

- Confidence in Transactions: Provides peace of mind with enhanced security measures.

Key Points to Note:

- While voluntary for cheques between ₹50,000 and ₹5 lakhs, it is mandatory for cheques above ₹5 lakhs.

- Details cannot be modified or deleted once submitted.

- Customers can still stop cheque payments before processing.

Procedure to register for the PPS:

- To register, complete a one-time enrolment for your cheque-operated account.

- Banks like SBI offer registration through digital platforms such as Internet Banking and the YONO app.

- Customers must select an account-level limit based on their risk preferences.

- Mandatory registration applies for cheques exceeding ₹5 lakhs in Savings Accounts and ₹10 lakhs for Current Accounts and other types.

The Positive Pay System is a revolutionary tool for ensuring secure cheque transactions.

By adopting this system, customers can effectively minimize risks and enhance financial security in an increasingly digital era.

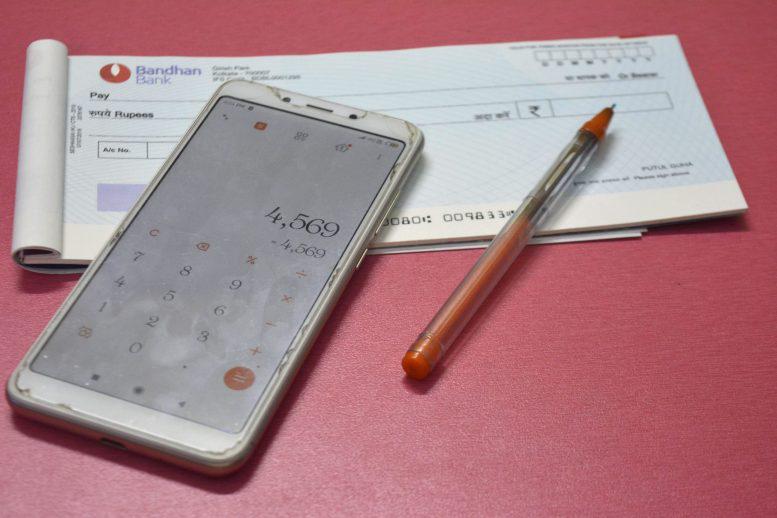

Image by Puja Guha from Pixahive (Free for commercial use / CC0 Public Domain)

Image Published on October 14, 2020

Image Reference: https://pixahive.com/photo/cheque/