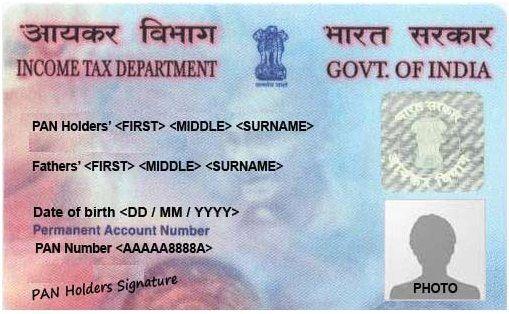

New PAN card rules

A permanent Account Number (PAN) is essential for many financial transactions. Now, the government made new rules for cash deposits of ₹20 lakhs or more in a bank or post office in any financial year.

The Central Board of Direct Taxes (CBDT) issued new rules on quoting the PAN and Aadhaar card numbers for cash transactions of ₹20 lakhs or more in a financial year. These rules will come into force from 26th May.

As per the new rule, PAN and Aadhaar cards are mandatory for cash deposits of ₹20 lakhs or more in one or multiple accounts in a bank, co-operative bank, or post office. The same applies to withdrawals of ₹20 lakhs or more from a bank, co-operative bank, or post office in a financial year.

PAN and Aadhaar cards are mandatory for opening a current account. They will be essential for opening a cash credit account in a bank, co-operative bank, or post office.

Quoting PAN is mandatory for the following financial transactions:

- To open an account with a banking company or a co-operative bank except for a Basic Savings Bank Deposit Account.

- For the purchase and sale of a motor vehicle except for two-wheelers.

- To apply for a credit card.

- If payment of cash exceeds ₹50,000 in connection with foreign travel or to purchase foreign currency worth ₹50,000 or more at any one time.

- For cash deposits of ₹50,000 or more in a single day in a bank account.

- To open a DEMAT account with a depository or a participant with SEBI. For bill payment of ₹50,000 or more in cash in a restaurant or hotel at any one time.

- If the purchase value of bonds or mutual funds exceeds ₹50,000.

- To purchase gold jewellery worth ₹2 lakhs or more in cash or through a card.

- If payment of life insurance premium exceeds ₹50,000 in a financial year.

Many other financial transactions also need PAN.

Image Credit: PageImp / CC BY-SA 4.0, via Wikimedia Commons

Image Reference: https://commons.wikimedia.org/wiki/File:A_sample_of_Permanent_Account_Number_(PAN)_Card.jpg

Leave a Reply