Inactive UPI IDs will be deactivated after December 31

In a bid to enhance security and prevent inadvertent fund transfers, the National Payments Corporation of India (NPCI) has introduced stringent guidelines.

These guidelines will lead to the deactivation of inactive UPI (Unified Payments Interface) IDs.

This move impacts users across all banks and third-party apps, including popular platforms like Google Pay and PhonePe.

Transitioning into the details, the NPCI has set a crucial deadline of December 31, beyond which UPI IDs exhibiting a year-long inactivity will face deactivation.

To enforce this, all banks and third-party apps are mandated to verify both the UPI ID and the associated cellphone number of dormant users, adhering to the newly outlined guidelines.

These guidelines dictate that UPI IDs with no recorded transactions—neither credits nor debits—over the past year will be blocked.

Commencing from the onset of the new year, users with such inactive IDs will find themselves unable to conduct transactions.

Acknowledging the potential inconvenience to users, NPCI has granted banks and third-party apps a grace period until December 31 to identify these inactive UPI IDs.

Users are expected to receive notifications through email or messages from their respective banks before the deactivation process commences.

The primary objective behind these measures is to curb instances of funds being erroneously transferred to unintended recipients.

In recent times, several cases have come to light where individuals change their mobile numbers without deactivating the associated UPI ID.

Subsequently, new users inheriting these numbers face the risk of incorrect transactions due to the lingering association with the previous UPI ID.

As technology evolves, securing digital payment ecosystems becomes paramount, and NPCI’s proactive approach to deactivating inactive UPI IDs serves as a crucial step in bolstering the integrity of the system.

Users are urged to heed notifications from their banks and take necessary actions to prevent disruptions to their UPI transactions come the new year.

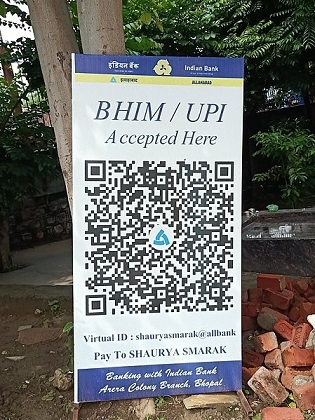

Image Credit: Suyash.dwivedi, CC BY-SA 4.0, via Wikimedia Commons

Image Reference: https://commons.wikimedia.org/wiki/File:Bhim_upi_ID_to_accept_entrance_fee_at_Shaurya_Smarak_Bhopal.jpg

Leave a Reply