4 Smart Ways To Save Tax

The Indian Income Tax Act allows for the certain deductions which can be claimed to save tax at the time of filling income tax return.

Everyone wants to increase their income and everyone want to save taxes & everyone has the scope of saving tax.

There are many ways which can cut your tax outgo.

Here you can find 4 smart ways to save your tax:

Save Tax on Rent Payment

We get a job in a different city or place. We go there to do our job. If the company does not give us accommodation, we should rent out. We live in rented house because of our job.

Therefore, expense of rent should be deducted from the taxable income. Employers do give some part of your remuneration as house rent allowance(HRA). You subtract this HRA from your gross income. However, you cannot take full benefit of HRA for tax saving. There is a formula for the HRA tax benefit.

You can deduct the lowest of these from gross income.

- Actual HRA given by the employer

- 50% of the basic salary plus DA if the employee is situated in Delhi, Mumbai, Kolkata and Chennai. Else, 40% of the basic salary plus DA.

- Actual house rent paid by you, minus 10% of basic salary + DA.

HRA gives you big tax saving. Ask your employer to keep the provision of HRA in your salary structure.

Don’t forget to take rent receipts from your house owner. If your total rent of a financial year exceeds 1 lakh, then you need to give copies of registered lease agreement and copy of the homeowner’s PAN card. You can also give the rent to your parents. But you should complete all the formalities of lease as stated above.

Medical Insurance Deduction

Medical Insurance expense gives you the deduction, over and above the 1.5 lakh limit. You can save tax for the health insurance premium of your family and dependent parents. Also, health check-up can also give you tax saving.

You can deduce these expenses from your total taxable income.

Up to Rs. 25,000 for the health insurance of self and family. You can also include health check-ups of up to Rs. 5,000 within this limit.

Up to Rs. 25,000 for the health insurance of parents. If they are above 60 years, This limit goes up to Rs. 30,000.

Save Tax Through Salary Restructuring

There may be many expenses which you are doing because of your job. If you leave your job today, many of your expenses will end. Such as you wear a uniform just for the sake of your job.

You travel to the office daily only for the job. You may be entertaining clients and spending over them to fulfill your job. You must be reading certain newspapers, magazines or books for your job purpose.

If you leave the job such expenses would end. It means, these are forced expenses and your employer should pay for them. Such expenses should go to the account of employer expense. Since you are only medium of such expense this should not be part of your income.

Talk to your employer and ask to restructure your pay. You should get perks and allowances for such expense. This should not be part of your salary.

These perks and allowances or non-taxable if incurred. However, you need to give proof of these expenses to avail tax free allowances.

Like; Conveyance, Driver, Newspaper, Books and Magazine, Medical Treatment, Uniform, Telephone and Mobile, Personality Development, Office Entertainment.

However, these allowances are given as per the grade. You can’t ask all of them. Your employer will decide the eligibility of allowances. You can only demand.

Leave Travel Allowances and Medical Expense

Some personal expenses are also eligible for exemptions. These Expenses are deducted from your gross salary. Your employer may give you part of your salary as medical allowance. Check with the HR department.

If you produce an actual bill of medical expenses, this allowance becomes tax-free. So, start collecting medical bills. However, it is limited to Rs. 15,000 in a financial year. You can give receipts of medical expense of your dependents as well.

Your employer can give you leave travel allowance as well. You are entitled to tax-free leave travel allowance.

- It is also limited to two times in a block of 4 years.

- The travel should occur while you are on the leave.

- It should be within India.

- Travel should be from the shortest route.

- You can claim the maximum for AC-I of the train journey and economy class of air travel.

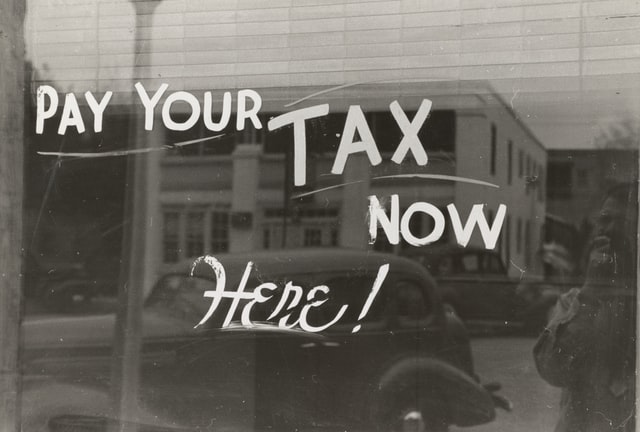

Photo by The New York Public Library on Unsplash (Free for commercial use)

Image Reference: https://unsplash.com/photos/kAJLRQwt5yY

Leave a Reply