Things to know about Advance Tax

In India, the concept of advance tax refers to a system where individuals, companies, and businesses make tax payments in advance rather than waiting until the end of the financial year.

Under this system, taxpayers are required to estimate their income for the year and calculate the corresponding tax liability.

Based on this estimation, they must make regular instalments of tax payments on specific due dates set by the Income Tax Department.

According to section 208 of the Income Tax Act, anyone whose estimated tax liability for the year is ₹10,000 or more is obligated to pay their taxes in advance.

This applies to salaried employees, self-employed individuals, businesses, trusts, and partnerships. Salaried employees typically have their advance tax taken care of through TDS (Tax Deducted at Source) by their employers.

However, additional sources of income such as interest, rental income, or capital gains may increase their tax liability, necessitating the estimation of tax payments in advance.

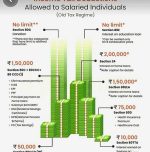

The calculation and payment of advance tax follow a specific schedule. For all taxpayers except those falling under section 44AD or 44ADA of the Income Tax Act, the advance tax is calculated as follows:

At least 15% of the estimated tax liability must be paid on or before June 15. 45% of the tax by September 15 and 75% of the tax must be paid by December 15. 100% of the tax must be paid by March 15.

However, for eligible taxpayers falling under section 44AD or 44ADA, the entire tax liability must be paid by March 15.

The presumptive taxation scheme outlined in section 44AD aims to provide relief to small taxpayers engaged in various businesses. But it excludes the business of plying, hiring, or leasing goods carriages as mentioned in section 44AE.

This scheme can be adopted by resident individuals, resident Hindu Undivided Families, and resident partnership firms (excluding Limited Liability Partnership firms).

The due dates for the payment of advance tax instalments vary depending on the taxpayer’s category. For all taxpayers, except those falling under section 44AD or 44ADA, the first instalment is due on June 15 and other dates are mentioned above.

It is important to note that failure to pay the advance tax by the due date will result in interest being levied at a rate of 1% per month on the outstanding amount.

Advance tax serves as a means for individuals, companies, and businesses in India to make tax payments in advance, based on their estimated income for the year.

By following the prescribed schedule and making timely payments, taxpayers can fulfil their tax obligations and avoid penalties or interest charges.

Photo by Recha Oktaviani on Unsplash (Free for commercial use)

Image Reference: https://unsplash.com/photos/h2aDKwigQeA

Leave a Reply