PAN rules set for major overhaul from April 2026

India’s tax framework is poised for significant compliance reforms.

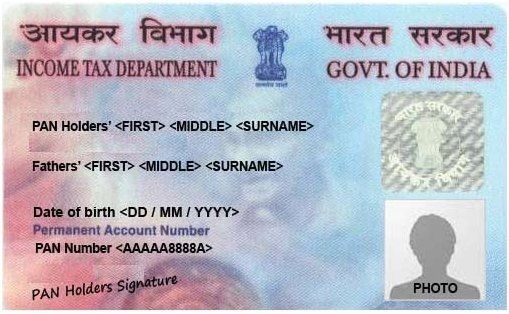

The government has proposed higher thresholds for quoting the Permanent Account Number (PAN) in routine financial transactions.

These changes appear in the draft Income Tax Rules, 2026. They align with the new Income Tax Act, 2025, effective April 1, 2026.

Most notably, cash transaction limits may see a sharp revision. Under the draft, PAN will be required only if total cash deposits or withdrawals reach ₹10 lakh in a financial year.

This can apply across one or multiple bank accounts. Currently, individuals must quote PAN for cash deposits above ₹50,000 in a single day. Therefore, the shift to an annual aggregate limit could reduce frequent compliance burdens.

Vehicle purchases may also see relief. Buyers would need to provide PAN only if the vehicle costs above ₹5 lakh. This includes two-wheelers.

At present, PAN is mandatory for purchasing any motor vehicle, regardless of value. Hence, the new threshold aims to ease rules for lower-priced vehicles.

Similarly, hospitality payments may face relaxed norms. PAN would become mandatory only when payments to hotels, restaurants, banquet halls, or event managers exceed ₹1 lakh.

Currently, the limit stands at ₹50,000. As a result, moderate spending in the sector may involve less documentation.

Real estate transactions will also reflect updated limits. The draft proposes raising the PAN threshold from ₹10 lakh to ₹20 lakh.

This applies to purchase, sale, gift, or joint development deals. The move acknowledges rising property prices and modernises outdated caps.

However, insurance rules may tighten. PAN would become compulsory for opening any account-based relationship with an insurer.

Currently, it is required only when annual life insurance premiums exceed ₹50,000. Thus, reporting obligations would begin at the account-opening stage.

Additionally, the draft proposes higher thresholds for employer perquisites. It also mandates crypto transaction reporting by exchanges. Furthermore, it recognises Central Bank Digital Currency as a valid electronic payment mode.

The CBDT has opened the draft for public consultation. Final rules are expected by early March. The reforms aim to simplify routine compliance while maintaining scrutiny over high-value transactions.

Image Credit: PageImp, CC BY-SA 4.0, via Wikimedia Commons

Image Reference: https://commons.wikimedia.org/wiki/File:A_sample_of_Permanent_Account_Number_(PAN)_Card.jpg