Different types of Cheques

A cheque is one of the most important and common forms of negotiable instrument. It is widely used in financial transactions. Any bank customer who has a savings bank account or current account can obtain a cheque from the bank.

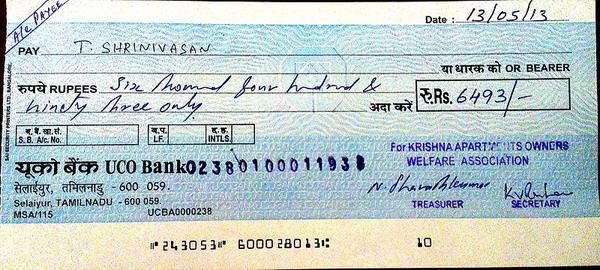

The person who writes a cheque or draws it in favour of someone is known as the drawer and the recipient or the person in whose favour the cheque is drawn is known as the payee. The bank on which the cheque is drawn or the bank of the drawer is known as the drawee.

A cheque should have the sign of the drawer, date, amount and the name of the payee. A cheque is valid for three months from date of issue.

There are different types of cheques:

- Bearer cheque is an open cheque. It does not need endorsement. That means no identity of the bearer is required. The bearer of the cheque can encash the amount. These type of cheques are risky and lead to loss of amount when they are misplaced.

- Self-cheques are used by drawer himself/herself to withdraw cash from the bank branch. Usually, these are used where the customer needs a huge amount which cannot be withdrawn from ATMs.

- Crossed cheque involves no cash withdrawal. The amount is transferred to the payee’s account from the drawer’s account. The drawer draws two lines at the left top corner of the cheque to indicate that it is a crossed cheque. He also writes ‘A/c payee’ in those lines.

- A mutilated cheque is a cheque that is torn into two or more pieces and the relevant information is missing on it. The bank shall reject it. However, if the corners of the cheque are torn and the important data on the cheque is intact, then banks may process it.

- Banker’s cheques are issued by the banks to guarantee payment.

- Traveller’s cheques are useful for withdrawal of money while travelling, especially abroad.

Image Credit: Tshrinivasan / CC BY-SA 3.0

Image Reference: https://commons.wikimedia.org/wiki/File:Sample_cheque.jpeg

Leave a Reply