Understanding IT filing requirements for seniors in India

Filing an Income Tax Return (ITR) is mandatory for individuals whose income exceeds the exemption limit.

For those under 60 years, an ITR must be filed if their gross total income surpasses ₹2.5 lakh in a fiscal year.

This basic exemption limit remains consistent under both the old and new tax regimes.

Senior citizens, defined as residents aged 60 years or above but less than 80, have different criteria for filing an ITR.

Super senior citizens, who are those aged 80 or older, also follow specific rules.

Notably, Section 194P of the Income Tax Act, 1961, effective from April 1, 2021, specifies conditions under which senior citizens aged 75 and above are exempt from filing income tax returns.

To be exempt from filing an income tax return, senior citizens must meet the following conditions:

- Age Requirement: The senior citizen must be 75 years old or older.

- Residency: The senior citizen must be a resident of India in the previous financial year.

- Income Source: The senior citizen should have income only from pension and interest, with the interest earned from the same specified bank where they receive their pension.

- Declaration: The senior citizen must submit a declaration to the specified bank.

- Tax Deduction by Bank: The bank specified by the Central Government will deduct TDS (Tax Deducted at Source) after considering deductions under Chapter VI-A and the rebate under Section 87A.

- Exemption from Filing: Once the specified bank deducts the tax, the senior citizen is not required to file an income tax return.

Even if the income is below the threshold, certain conditions make filing an ITR mandatory:

- Overseas Assets: Holding any asset outside India, including financial interests in any entity.

- Signing Authority: Having signing authority in any account located outside India.

- Beneficiary: Being a beneficiary of any asset located outside India.

Filing an ITR is mandatory under the seventh proviso to Section 139(1) if:

- Large Deposits: Deposited more than ₹1 crore in one or more current accounts with a bank or cooperative bank.

- Foreign Travel Expenditure: Incurred expenses exceeding ₹2 lakh on travel to a foreign country for oneself or others.

- High Electricity Bills: Incurred expenses exceeding ₹1 lakh towards payment of electricity bills.

- Business Income: Total sales, turnover, or gross receipts from a business exceed ₹60 lakh during the previous financial year.

- Professional Income: Total gross receipts from a profession exceed ₹10 lakh during the previous financial year.

- Tax Deduction and Collection: The total tax deducted and collected during the previous year is ₹25,000 or more, or ₹50,000 for residents aged 60 or more.

- Savings Bank Deposits: The aggregate deposit in one or more savings bank accounts exceeds ₹50 lakh during the previous financial year.

Understanding these criteria helps individuals comply with tax laws and avoid penalties.

Staying informed about the requirements for filing an ITR ensures that taxpayers meet their obligations and maintain financial compliance.

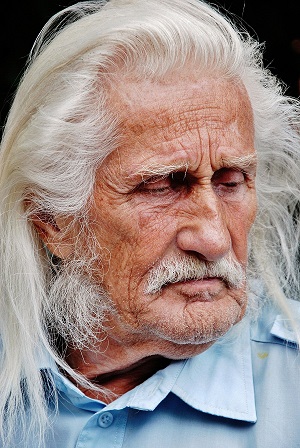

Image from Pxhere (Free for commercial use / CC0 Public Domain)

Image Reference: https://pxhere.com/en/photo/1130811

Leave a Reply