Rupeek’s gold loan revolution: Tech-driven credit access for Indians

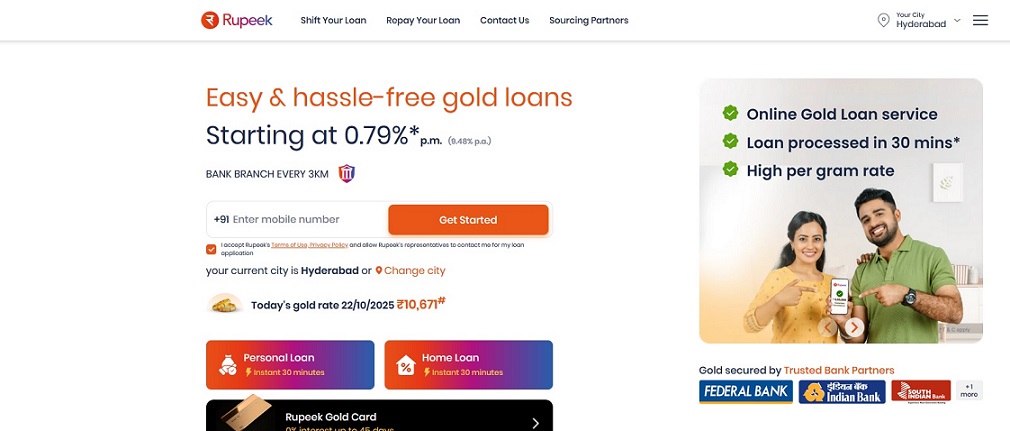

Rupeek, one of India’s fastest-growing fintech companies, is transforming how Indians access credit by unlocking the economic potential of household gold.

With over 56% of household debt unsecured and 95% of wealth tied up in physical assets like gold, Rupeek aims to bring formal credit access to the middle and lower economic segments, using technology, trust, and doorstep service.

Founder & CEO Sumit Maniyar believes millions of Indians can benefit if gold is better monetised.

That belief has powered Rupeek’s doorstep gold loan service, which allows customers to access loans without visiting a branch.

Rupeek agents pick up, secure, and release gold at the customer’s home, while the assets are safely stored with trusted partner banks.

This convenient and secure model has already helped 100,000+ customers across 35+ cities access much-needed credit.

In fact, Rupeek clocked an astonishing 7,295% revenue growth in three years, earning recognition as India’s fastest-growing tech company by Deloitte.

To support its explosive growth, Rupeek has overhauled operations using Salesforce Service Cloud.

This has streamlined post-disbursal processes, automated workflows, and created a single customer view across departments.

- Customers can raise service requests via app, call, email, or chat.

- Teams access unified customer data, reducing duplicate calls by 20-30%.

- Issue resolution is faster and smoother, improving agent productivity by 50%.

With Salesforce dashboards and reports, teams now have access to real-time insights.

Combined with Tableau Analytics, Rupeek is enhancing financial reconciliation and optimising accounting systems involving multiple loan structures and lenders.

Rupeek aims to build an entire financial ecosystem around gold, expanding into new asset classes and improving credit access for all.

Its next goal is to unify the customer journey across marketing, servicing, and closure, delivering truly connected experiences.

With cutting-edge tech and a bold mission, Rupeek is not just changing gold lending; it’s redefining financial inclusion in India.

Image Credit: Rupeek Website Screenshot

Image Reference: https://rupeek.com/