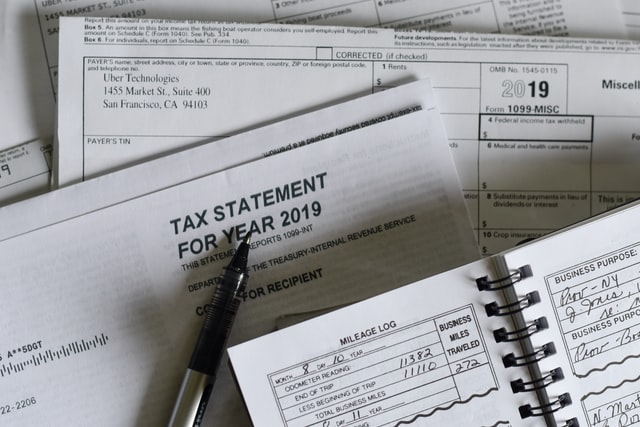

How To Pick The Right Income Tax Form

On the off chance that you are planning to record your tax document physically this year, you might scan for counsel on the most proficient method to pick the correct salary tax form.

Often, the most significant and popular advice when it comes to dealing with income tax is to choose the simplest and shortest form that can apply to you and your specific needs.

Generally, when you are figuring out how to choose the right income tax form, you will find that the quicker you can fill out your form, the quicker the IRS will be able to respond to you.

Occupant outsider and U.S. citizens have three options when it comes to filing their federal income tax:

- The standard form: 1040

- A smaller version of the standard form: 1040A

- The shortest and fasted form: 1040EZ

The Standard Form

Taxpayers can utilize the 1040 tax form if they want to. Although it generally takes longer to fill out, and can be more complex, the 1040 form can be ideal for handling any situation, regardless of how complex it might be.

You can utilize form 1040 on the off chance that you are separating your findings, for example, philanthropies or home loan conclusions, if you’ve had remote wages or paid outside charges, on the off chance that you have an assess able wage of $100,000 or more, or on the off chance that you’ve sold securities, stocks, property or shared assets.

This may likewise be the right shape for you if you are guaranteeing alterations on your salary for well-being bank accounts or moving costs.

The Short Form

An extensive bit of citizens will meet all requirements to utilize the 1040A frame, which permits you to assert the biggest measure of basic changes in accordance with wage.

In case you’re thinking about how to pick the correct wage tax document, the 1040A might be the correct decision for you, on the off chance that you will assert the standard conclusion.

With the 1040A, you can claim child and dependent car credit, American opportunity credit, credit for the elderly and disabled, retirement contributions credit, child tax credit and earned income credit.

Often, the guardians of college students prefer to use this form instead of the 1040, as it can help their children achieve a better package for financial aid under the test for simplified needs.

The Easy Form

It is possible to use the 1040 EZ form, the simplest and shortest tax form, the least complex and most brief tax document, on the off chance that you have an asses sable salary underneath $100,000, and an intrigue pay of under $1,500.

Your income should only be from unemployment compensation, wages, interest, and permanent fund dividends. You and your spouse will need to be under the age of 65, and have no adjustments to your income.

To use the easiest form, you will need to be happy with accepting the standard deduction, and you cannot claim any other tax credits.

Conclusion

Choosing the right income tax form to file will depend largely on your own personal circumstances, but often you will find that the more research you do, the easier the choice becomes.

Photo by Olga DeLawrence on Unsplash (Free for commercial use)

Image Reference: https://unsplash.com/photos/5616whx5NdQ

Leave a Reply